June 30, 2020

Why We’re Blind to Probability

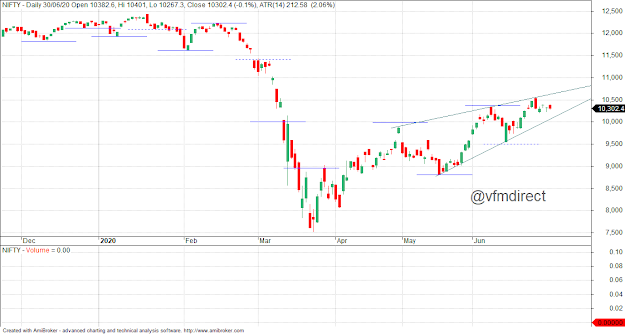

NIFTY EOD charts

June 29, 2020

NIFTY intraday charts

NIFTY EOD charts

June 28, 2020

NIFTY bar charts multiple timeframes

June 27, 2020

June 26, 2020

NIFTY EOD charts

A 50% win rate is all you need

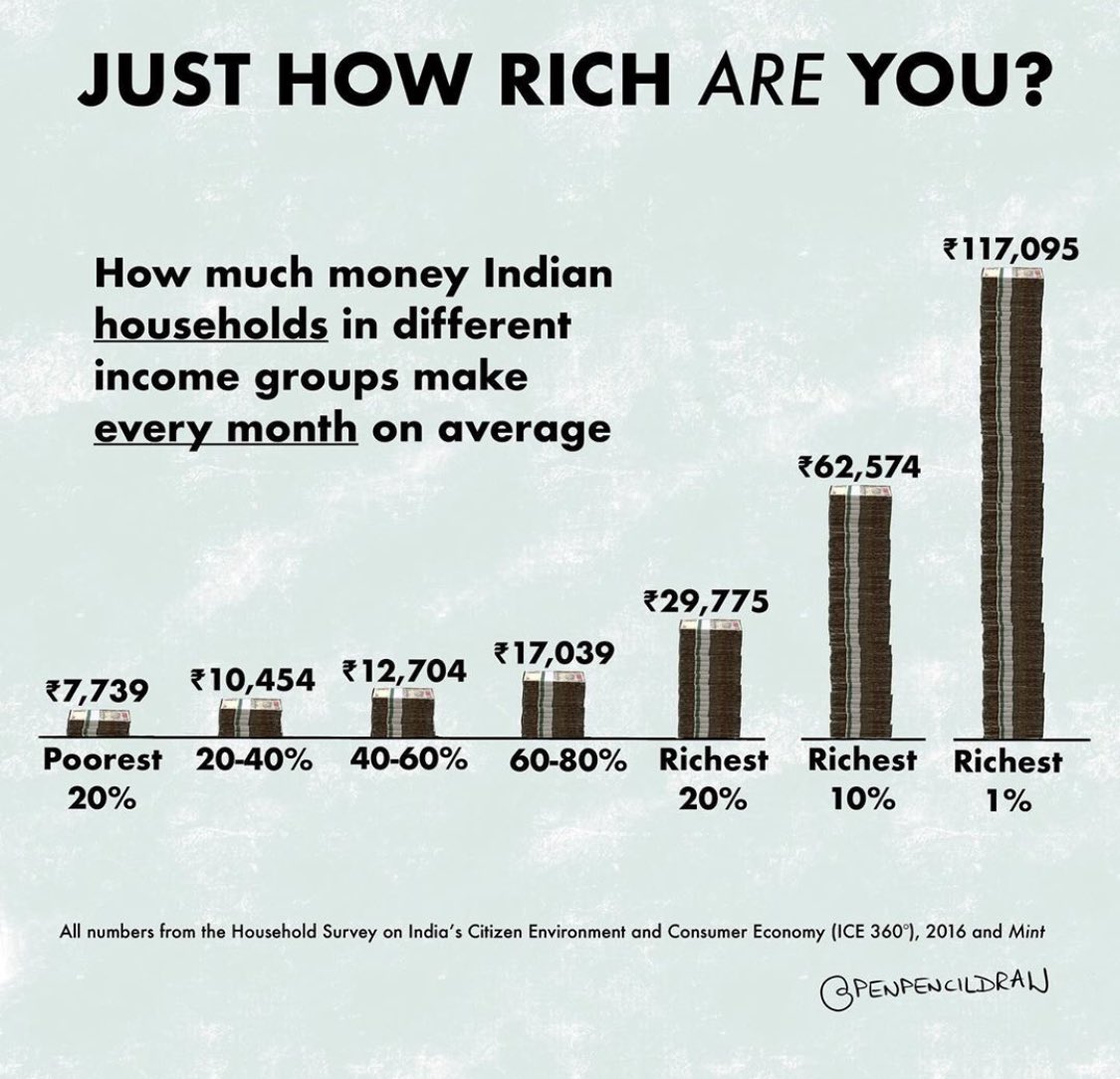

Indian citizens giving stimulus to the government?

#Petrol price hiked by 21 paise, #diesel by 17 paise in Delhi Today. Both petrol & diesel at over Rs 80/L. Petrol costs Rs 80.13/L & Diesel Rs 80.19/L In Delhi.

— CNBC-TV18 (@CNBCTV18Live) June 26, 2020

In the last 20 days, petrol price raised by Rs 8.87/L & diesel by Rs 10.56/L pic.twitter.com/V6l6DMQHTA

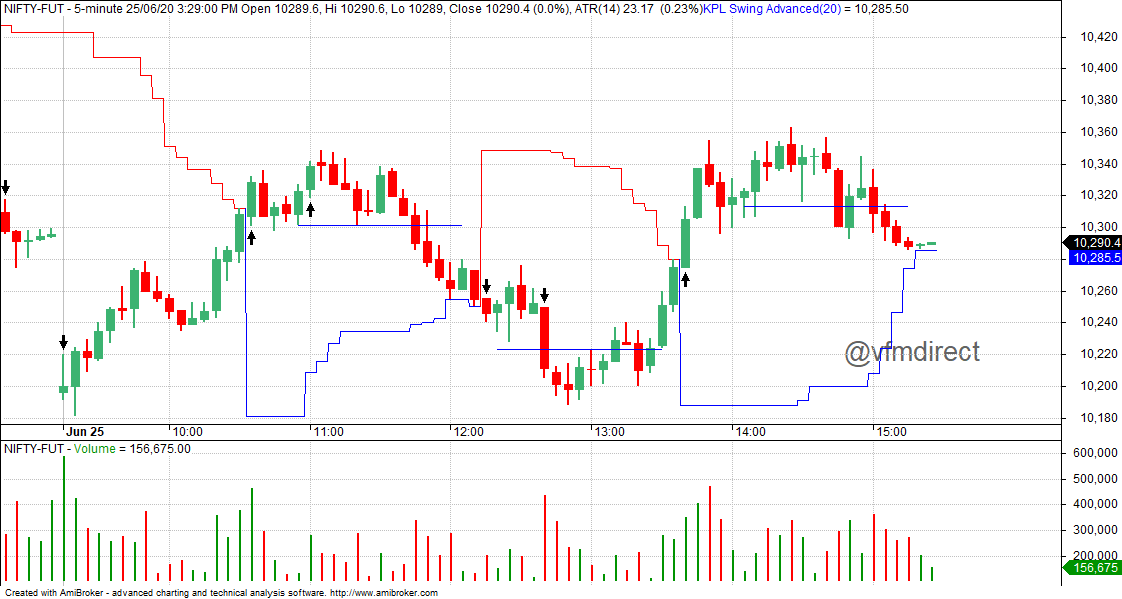

June 25, 2020

NIFTY intraday charts

NIFTY EOD charts

June 24, 2020

NIFTY intraday charts

NIFTY EOD charts

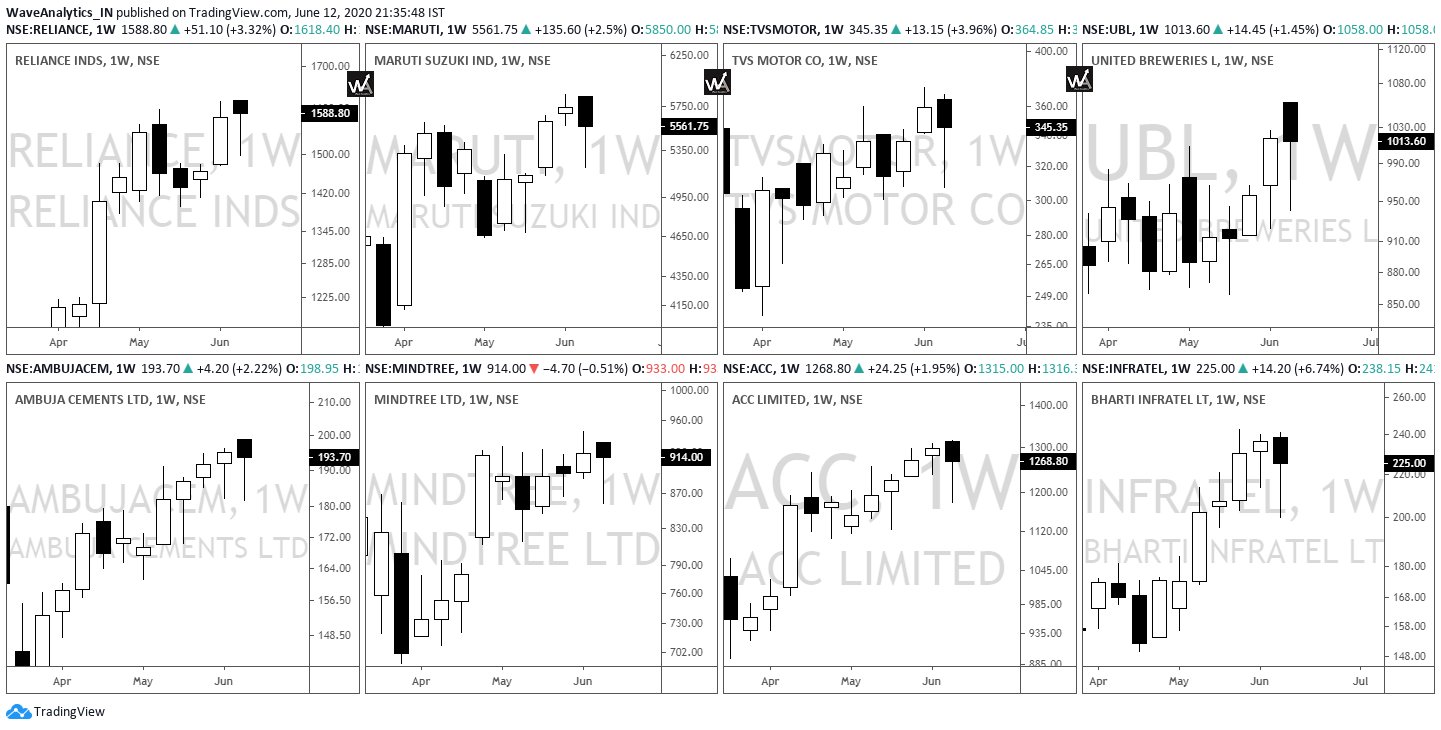

AllStarCharts: RELIANCE has 35% more upside

The curious case of GLENMARK Pharma

- Favipiravir drug cannot change the fortunes of Glenmark Pharmaceuticals in terms of revenue or profits. So if you do want to buy or sell the stock, do your own research on the total business of the company.

- Just because a company is covered by all news sources does not make it a great buy. Do your own research.

- Even with a 5-6% of the company getting traded in a day and not a buy name in the bulk deals and hardly any Mutual Fund ownership suggests there is no major institutional interest in the company. ( We will know more when the quarterly shareholding pattern comes out. )

- Would be interesting to see who bought the 25-40% pop. Was it retail or institutions. Will wait for the Quarterly shareholding and Mutual Fund Factsheets post current month.

- I have no major view on the stock price but a simple technical take would be the opening and low price of 450 on the announcement day is important. If it does not hold up it makes the technical trend negative. A fresh look technically if it can sustain above the highs of 550-570. But preference would be to do nothing

- No Positions on the stock or understanding of the company just a view based on publicly available price and volume data. Do your own research – Not a recommendation to buy or sell.

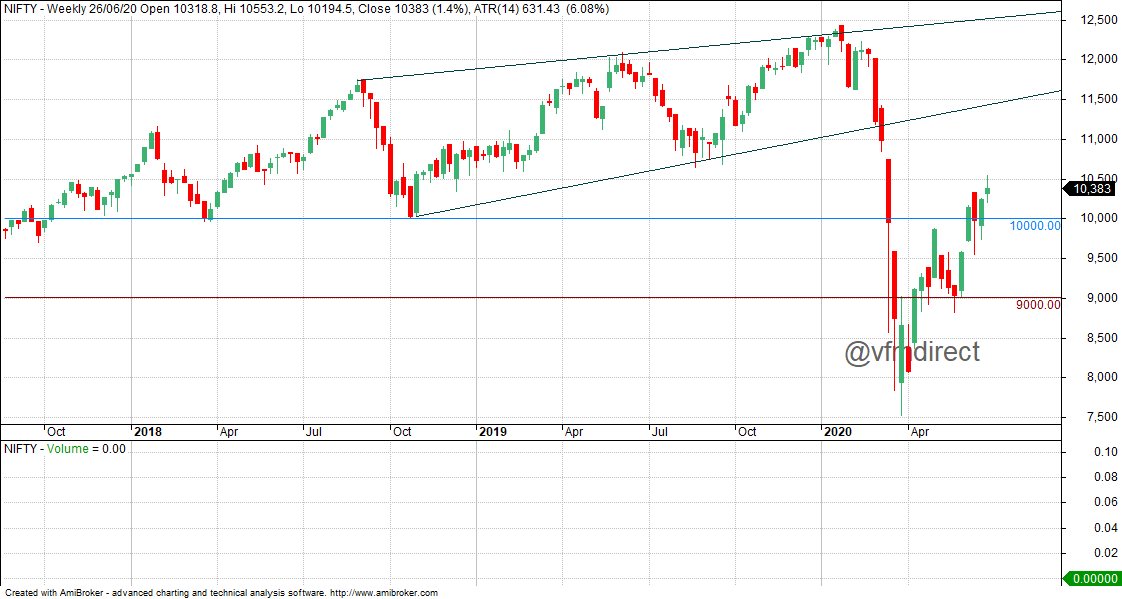

NIFTY nearing top?

#Nifty

— Peter Brandt (@PeterLBrandt) June 24, 2020

Time to start paying attention. Market is fast approach the 10,600 zone of likely resistance

1. Look for signs of a top

2. Identify a measured-risk entry

3. Always trade with protective stop orders

4. Risk no more than 50-70 basis points

5. Try it twice, then abandon ship pic.twitter.com/lRu3Ngws9Q

June 23, 2020

NIFTY EOD charts

June 22, 2020

RELIANCE Big Boss

Reliance is a BIG BOSS On Nifty

— Nigel D'Souza (@Nigel__DSouza) June 22, 2020

1)RIL weightage on Nifty

Today at 13.5% vs 5.3% in 2016

2)RIL weight “ALONE” On Nifty🏋️♂️💪

=22 Nifty Cos

=TCS+INFY+ HCLTECH (13%)

=ITC+HUL+BRITANNIA+ ASIANPAINT+NESTLE+TITAN (13.4%)

=TAMO+EICHER+HEROMOTO+BAJAJ+MARUTI (5%)#Nifty #StockMarket

NIFTY EOD charts

June 21, 2020

June 20, 2020

June 19, 2020

NIFTY EOD charts

BANKNIFTY breakout

BANKNIFTY EOD charts... above 22000, 25000-26000 possible pic.twitter.com/6Dg9xYCth7

— KPL (@vfmdirect) June 19, 2020

Buy signal on BANKNIFTY hourly charts... SL at 4-5 bar low pic.twitter.com/jblXnxditU

— KPL (@vfmdirect) June 19, 2020

June 18, 2020

NIFTY EOD charts

June 17, 2020

NIFTY intraday charts

NIFTY EOD charts

June 16, 2020

Market outlook

Global Equities Could Be Topping Out Again

June 15, 2020

June 13, 2020

June 3, 2020

Market outlook

NIFTY options range

| NIFTY close | 10062 | Date | 3-Jun-2020 |

| VIX | 30.00% | ||

| Levels | Strike price | Significance | |

| Month Hi | 10,933 | 11,000 | Resistance |

| Week Hi | 10,481 | 10,500 | Resistance |

| Day Hi | 10,220 | 10,300 | Resistance |

| Day Lo | 9,904 | 9,900 | Support |

| Week Lo | 9,643 | 9,600 | Support |

| Month Lo | 9,191 | 9,100 | Support |

| Levels are for day/ week/ month starting tomorrow | |||

| Strike price is arrived after rounding up/ down of levels | |||

| Range expansion if VIX explodes | |||

| For educational purposes only. Not for trading | |||

| Updated daily at vfmdirect.in | |||

June 2, 2020

NIFTY options range

| NIFTY close | 9980 | Date | 2-Jun-2020 |

| VIX | 30.00% | ||

| Levels | Strike price | Significance | |

| Month Hi | 10,844 | 10,900 | Resistance |

| Week Hi | 10,395 | 10,400 | Resistance |

| Day Hi | 10,137 | 10,200 | Resistance |

| Day Lo | 9,823 | 9,800 | Support |

| Week Lo | 9,565 | 9,500 | Support |

| Month Lo | 9,116 | 9,100 | Support |

| Levels are for day/ week/ month starting tomorrow | |||

| Strike price is arrived after rounding up/ down of levels | |||

| Range expansion if VIX explodes | |||

| For educational purposes only. Not for trading | |||

| Updated daily at vfmdirect.in | |||

June 1, 2020

Market outlook

NIFTY options range

| NIFTY close | 9826 | Date | 1-Jun-2020 |

| VIX | 31.00% | ||

| Levels | Strike price | Significance | |

| Month Hi | 10,705 | 10,800 | Resistance |

| Week Hi | 10,248 | 10,300 | Resistance |

| Day Hi | 9,985 | 10,000 | Resistance |

| Day Lo | 9,667 | 9,600 | Support |

| Week Lo | 9,404 | 9,400 | Support |

| Month Lo | 8,947 | 8,900 | Support |

| Levels are for day/ week/ month starting tomorrow | |||

| Strike price is arrived after rounding up/ down of levels | |||

| Range expansion if VIX explodes | |||

| For educational purposes only. Not for trading | |||

| Updated daily at vfmdirect.in | |||