January 31, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.6% in negative at 11962

- AD was 7:11

- note this is the 2nd time nifty is closing below 12000

- first time was on 6th JAN

- today is last trading day of JAN

- monthly candlestick is a red bar (after 4 green/ blue bars)

- trend is up on daily charts

- today nifty closed 0.6% in negative at 11962

- AD was 7:11

- note this is the 2nd time nifty is closing below 12000

- first time was on 6th JAN

- today is last trading day of JAN

- monthly candlestick is a red bar (after 4 green/ blue bars)

Possible 10-15% correction in NIFTY 500

Nifty 500 aka CNX500 trading between 8400-10000 levels since June 2017. Recently Nifty 500 for some time struggled around the psychological reference 10000 levels. Broken outside the upper balance, however, failed to continue sustaining above the balance indicating possible tired investors.

Look above the balance and fail is a critical sign of momentum exhaustion and bring a potential target destination of another side of the balance which roughly comes around 8400-8650 levels.

Read more at https://www.marketcalls.in/analysis/look-above-the-balance-fail-in-nifty-500-suggests-possible-10-15-correction.html

Look above the balance and fail is a critical sign of momentum exhaustion and bring a potential target destination of another side of the balance which roughly comes around 8400-8650 levels.

Read more at https://www.marketcalls.in/analysis/look-above-the-balance-fail-in-nifty-500-suggests-possible-10-15-correction.html

January 30, 2020

The Ultimate Guide to Moving Averages: Trend Analysis the Pro’s Way

Moving averages help me determine:

In terms of importance, I rate moving averages above news, economic data, earnings, and just about any indicator you can think of.

If I was a beginning trader looking to build my net worth, moving averages would be my #1 focus.

And through a series of helpful case studies, you're about to learn:

Read more at https://www.t3live.com/blog/2019/07/23/scott-redler-moving-averages-guide/

- How aggressive to be with my portfolio

- Which stocks I want to be long or short

- Just how strong the current market trend is

- What news matters, and what doesn't

In terms of importance, I rate moving averages above news, economic data, earnings, and just about any indicator you can think of.

If I was a beginning trader looking to build my net worth, moving averages would be my #1 focus.

And through a series of helpful case studies, you're about to learn:

Read more at https://www.t3live.com/blog/2019/07/23/scott-redler-moving-averages-guide/

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.8% in negative at 12035

- AD was 1:2

- note trend is down on hourly charts for quite some time

- below 12200 I should have marked the trend as down

- but did not do as the region of 11800 to 12200 is a huge congestion zone

- today markets took support at 12000

- Saturday is a big event day from market perspective

- I am not expecting anything great from the budget

- however the volatility can get bad so I will not be trading

- trend is up on daily charts

- today nifty closed 0.8% in negative at 12035

- AD was 1:2

- note trend is down on hourly charts for quite some time

- below 12200 I should have marked the trend as down

- but did not do as the region of 11800 to 12200 is a huge congestion zone

- today markets took support at 12000

- Saturday is a big event day from market perspective

- I am not expecting anything great from the budget

- however the volatility can get bad so I will not be trading

January 29, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.6% in positive at 12129

- AD was 5:4

- VIX down 5%

- option writing support 12000

- today markets were up but OI down 10%

- trend is up on daily charts

- today nifty closed 0.6% in positive at 12129

- AD was 5:4

- VIX down 5%

- option writing support 12000

- today markets were up but OI down 10%

How nifty will change in the coming decade

Going by the historical trend since the Nifty was created, almost all the entrants into the Nifty over the next decade will come from 100 stocks currently just underneath the Nifty. In order to assess which of these 100 companies will find themselves in the benchmark a decade hence, it is worth first trying to assess how the Indian economy will change over the coming decade.

We see three noteworthy changes taking place in India over the next decade:

1) India is already an economy with extraordinary levels of profit share concentration in many key sectors. For example, in paints (Asian Paints, Berger Paints), premium co...

Read more at https://marcellus.in/blogs/how-the-nifty-will-change-in-the-coming-decade/

We see three noteworthy changes taking place in India over the next decade:

- The continuing formalisation of the economy and the concentration of profit share in almost every sector in the hands of one or two companies.

- The formalisation of savings, away from physical savings, and toward financial savings.

- The continuing formalisation of retail and, more generally, of distribution channels in India.

- Let’s delve deeper into each of these changes.

1) India is already an economy with extraordinary levels of profit share concentration in many key sectors. For example, in paints (Asian Paints, Berger Paints), premium co...

Read more at https://marcellus.in/blogs/how-the-nifty-will-change-in-the-coming-decade/

Mistaking luck for skill

The potential for temporary success by pure luck beguiles people into thinking that trading is a lot easier than it is. The potential for even temporary success doesn’t exist in any other profession. If you have never trained as a surgeon, the probability of your performing successful brain surgery is zero. If you have never picked up a violin, your chances of playing successful solo violin in front of the New York Philharmonic are zero. It is just that trading has this quirk that allows some people to be successful temporarily without true skill or an edge—and that fools people into mistaking luck for skill.

The key here is the overwhelming odds of denial when experiencing luck. Associating success with skill feels amazing. And it feels amazing because you get excited about your ability to repeat it. The thrill of a winning trade is not just the money you make; it’s the money you anticipate you’ll keep making in the future.

The key here is the overwhelming odds of denial when experiencing luck. Associating success with skill feels amazing. And it feels amazing because you get excited about your ability to repeat it. The thrill of a winning trade is not just the money you make; it’s the money you anticipate you’ll keep making in the future.

January 28, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed 0.5% in negative at 12060

- AD was 1:2

- note broader market is showing a lot of strength

- even today, stocks at 52 week high are more than stocks at 52 week lows

- and this is even as nifty is correcting

- few months ago, it was the opposite

- note cluster of supports between 12000 and 11800

- trend is up on daily charts

- today markets closed 0.5% in negative at 12060

- AD was 1:2

- note broader market is showing a lot of strength

- even today, stocks at 52 week high are more than stocks at 52 week lows

- and this is even as nifty is correcting

- few months ago, it was the opposite

- note cluster of supports between 12000 and 11800

January 27, 2020

January 26, 2020

January 25, 2020

NIFTY weekly charts

- trend is up

- bearish engulfing bar formed this week

- but prev week's trading range was extremely small

- and this week candlestick showed buying at lower levels

- at same time, markets at trendline resistance

- option writing support 12000

- this is also prev swing high which offered strong resistance

- so it should now offer support

- bearish engulfing bar formed this week

- but prev week's trading range was extremely small

- and this week candlestick showed buying at lower levels

- at same time, markets at trendline resistance

- option writing support 12000

- this is also prev swing high which offered strong resistance

- so it should now offer support

January 24, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.6% in positive at 12248

- AD was 5:4

- option writing support 12000.. may increase to 12200

- trend is up on daily charts

- today nifty closed 0.6% in positive at 12248

- AD was 5:4

- option writing support 12000.. may increase to 12200

January 23, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.6% in positive at 12180

- AD was 10:7

- VIX down 3%

- lot of strength seen in mid caps and small caps

- correction is absent in these indices

- overall bias is bullish as long as index holds above 12000

- trend is up on daily charts

- today nifty closed 0.6% in positive at 12180

- AD was 10:7

- VIX down 3%

- lot of strength seen in mid caps and small caps

- correction is absent in these indices

- overall bias is bullish as long as index holds above 12000

January 22, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.5% in negative at 12107

- AD was 7:10 (not bad)

- option writing support 12000 resistance 12500

- resistance may shift down to 12200

- trend is up on daily charts

- today nifty closed 0.5% in negative at 12107

- AD was 7:10 (not bad)

- option writing support 12000 resistance 12500

- resistance may shift down to 12200

January 21, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.4% in negative at 12169

- AD was 4:5 (not bad)

- option writing support 12000 resistance 12300 (weekly expiry)

- option writing support 12000 resistance 12500 (monthly expiry)

- trend is up on daily charts

- today nifty closed 0.4% in negative at 12169

- AD was 4:5 (not bad)

- option writing support 12000 resistance 12300 (weekly expiry)

- option writing support 12000 resistance 12500 (monthly expiry)

January 20, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today, markets opened gapup and closed in the negative

- close was 1% down around 12224

- AD was 1:2

- VIX up 9%

- a huge bearish engulfing bar was formed today

- gap up was on back of very good results of REIANCE and HDFCBANK (both index heavyweights)

- this is a classic case of selling on good news

- on hourly charts, nifty is in sell mode

- 12300 was a very good support... it just broke easily

- huge call writing at 12300 and 12400 CE

- a top is in place?

- important support 12000

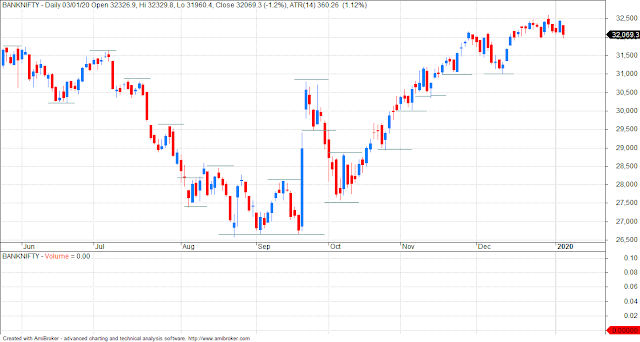

- weakest index this rally was BANKNIFTY... still no buy signal and probable H&S being formed

- trend is up on daily charts

- today, markets opened gapup and closed in the negative

- close was 1% down around 12224

- AD was 1:2

- VIX up 9%

- a huge bearish engulfing bar was formed today

- gap up was on back of very good results of REIANCE and HDFCBANK (both index heavyweights)

- this is a classic case of selling on good news

- on hourly charts, nifty is in sell mode

- 12300 was a very good support... it just broke easily

- huge call writing at 12300 and 12400 CE

- a top is in place?

- important support 12000

- weakest index this rally was BANKNIFTY... still no buy signal and probable H&S being formed

January 18, 2020

January 17, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 12352

- AD was flat

- overall this was a week with a very small trading range

- high low range was 110 points

- trend is up on daily charts

- today nifty closed flat at 12352

- AD was flat

- overall this was a week with a very small trading range

- high low range was 110 points

January 16, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 12356

- AD was 11:7

- option writing support 12000 resistance 12500 (monthly expiry)

- trend is up on daily charts

- today nifty closed flat at 12356

- AD was 11:7

- option writing support 12000 resistance 12500 (monthly expiry)

January 15, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 12343

- AD was 11:7

- midcaps/ small caps showed strength/ buying

- option writing support 12300

- trend is up on daily charts

- today nifty closed flat at 12343

- AD was 11:7

- midcaps/ small caps showed strength/ buying

- option writing support 12300

January 14, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.3% in positive at 12362

- AD was 11:7

- option writing support 12300

- put writing has been very aggressive this weekly series

- trend is up on daily charts

- today nifty closed 0.3% in positive at 12362

- AD was 11:7

- option writing support 12300

- put writing has been very aggressive this weekly series

January 13, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.6% in positive at 12329

- AD was 2:1

- swing low support 12000

- option writing support 12200

- note current area is a potential whipsaw zone

- trend is up on daily charts

- today nifty closed 0.6% in positive at 12329

- AD was 2:1

- swing low support 12000

- option writing support 12200

- note current area is a potential whipsaw zone

January 11, 2020

Behind the bipolar market behaviour

Institutions, led by mutual funds, are sticking to the safety of the top 250 stocks while retreating from the rest of the market

In recent times, India’s bellwether stock indices — the Nifty50 and Sensex30 — have behaved like the proverbial cat with nine lives. Dire events such as US-Iran hostilities, trade wars, India-Pakistan face-offs and the global recession scare, have triggered only shallow corrections in the indices from which they have bounced back smartly. They’ve brushed off fundamental factors such as India’s worsening GDP growth print, repeated earnings misses by India Inc and sky-high valuations, to scale new highs.

The index behaviour has caused much heartburn for domestic investors. Retail investors, the bulk of whose money is parked in the mid- and small-cap segments of the market, have seen their portfolios lose value while the Nifty50 and Sensex30 have notched up double-digit gains.

Read more at https://www.thehindubusinessline.com/opinion/columns/behind-the-bipolar-market-behaviour/article30536141.ece

In recent times, India’s bellwether stock indices — the Nifty50 and Sensex30 — have behaved like the proverbial cat with nine lives. Dire events such as US-Iran hostilities, trade wars, India-Pakistan face-offs and the global recession scare, have triggered only shallow corrections in the indices from which they have bounced back smartly. They’ve brushed off fundamental factors such as India’s worsening GDP growth print, repeated earnings misses by India Inc and sky-high valuations, to scale new highs.

The index behaviour has caused much heartburn for domestic investors. Retail investors, the bulk of whose money is parked in the mid- and small-cap segments of the market, have seen their portfolios lose value while the Nifty50 and Sensex30 have notched up double-digit gains.

Read more at https://www.thehindubusinessline.com/opinion/columns/behind-the-bipolar-market-behaviour/article30536141.ece

January 10, 2020

January 9, 2020

Market outlook

Daily charts:

- trend is sideways on daily charts

- today nifty closed 1.6% in positive at 12216

- AD was 13:5

- losses of 6th JAN have now been recovered

- VIX down 10%

- note high swings in VIX (15% one day then 10% down some other day)

- trend is sideways on daily charts

- today nifty closed 1.6% in positive at 12216

- AD was 13:5

- losses of 6th JAN have now been recovered

- VIX down 10%

- note high swings in VIX (15% one day then 10% down some other day)

January 8, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.2% in negative at 12025

- we had a gap down opening followed by buying

- AD was 7:11

- trend is down on daily charts

- today nifty closed 0.2% in negative at 12025

- we had a gap down opening followed by buying

- AD was 7:11

January 7, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.5% in positive at 12053

- AD was 2:1 (good)

- an inside bar/ day was formed

- VIX down 1.5%

- this is interesting as it was up 16% intraday

- anyone long in options at 16% IV has lost heavily on close

- highest OI at 12200 CE followed by 12000 PE in puts

- trend is down on daily charts

- today nifty closed 0.5% in positive at 12053

- AD was 2:1 (good)

- an inside bar/ day was formed

- VIX down 1.5%

- this is interesting as it was up 16% intraday

- anyone long in options at 16% IV has lost heavily on close

- highest OI at 12200 CE followed by 12000 PE in puts

January 6, 2020

Market outlook

Daily charts:

- trend is down on daily charts (wef today)

- today nifty closed 2% in negative at 11993

- AD was 2:7

- VIX up 17%

- next support 11800

- trend is down on daily charts (wef today)

- today nifty closed 2% in negative at 11993

- AD was 2:7

- VIX up 17%

- next support 11800

January 5, 2020

Intraday Margin Likely to Increase Sharply Even for Cover & Bracket Orders

In the recent circular, issued by NSE and BSE it is clarified that brokers have to collect additional intraday margins for equities & derivatives (Equity, Commodities, Currencies). This new regulation seems to be applicable even for exotic leveraged tools like cover orders & bracket orders.

Currently, brokers charge only VAR margins for Intraday Equity trades which will soon likely be VAR + ELM margin. And for FNO trades it is likely to be Initial Margin (Span + Exposure Margin) for intraday trades has to be collected upfront from the trader.

These newer regulations directly affect the traders & brokers community. It is negative news for the traders who looking for higher leverage to boost up their returns.

This Increase in margin will push more traders towards Option Buying or Short term Investing Strategies as higher margins reduce the liquidity supply from the retail segment.

Intraday based portfolio level algo traders/Systematic Traders are also the impacted ones.

Expiry Day Option Sellers are the most impacted ones as it simply destroys the higher returns the intraday option sellers make on those expiry day trades.

Overall, Controlled greed is good as it protects many entry-level traders from taking bigger leverage and thereby brings reasonable expectations in the markets.

Source: https://www.marketcalls.in/market-regulations/intraday-margin-likely-to-increase-sharply-even-for-cover-bracket-orders.html

Currently, brokers charge only VAR margins for Intraday Equity trades which will soon likely be VAR + ELM margin. And for FNO trades it is likely to be Initial Margin (Span + Exposure Margin) for intraday trades has to be collected upfront from the trader.

These newer regulations directly affect the traders & brokers community. It is negative news for the traders who looking for higher leverage to boost up their returns.

This Increase in margin will push more traders towards Option Buying or Short term Investing Strategies as higher margins reduce the liquidity supply from the retail segment.

Intraday based portfolio level algo traders/Systematic Traders are also the impacted ones.

Expiry Day Option Sellers are the most impacted ones as it simply destroys the higher returns the intraday option sellers make on those expiry day trades.

Overall, Controlled greed is good as it protects many entry-level traders from taking bigger leverage and thereby brings reasonable expectations in the markets.

Source: https://www.marketcalls.in/market-regulations/intraday-margin-likely-to-increase-sharply-even-for-cover-bracket-orders.html

January 4, 2020

How to create false propoganda

THREAD— Prajwal Kuttappa (@PrajwalKuttappa) January 4, 2020

BJP, the ruling party in India launched a missed call campaign, asking people to call 8866288662 & show their support to the controversial CAA 2019

This is how it's being propagated on Social media

This is how BJP works

This is how PROPAGANDA works

(Add & share ) pic.twitter.com/w97sW5YBoz

To extend your support for the historic Citizenship Amendment Act-2019 brought in by PM @NarendraModi’s government, to ensure justice to the religiously persecuted minorities from Pakistan, Bangladesh and Afghanistan, kindly give a missed call on 88662-88662. #IndiaSupportsCAA pic.twitter.com/g7pTItqYjA— Amit Shah (@AmitShah) January 3, 2020

Thread on proposed SEBI rules on FnO trading

4. Even a trader with 1 Crore in account can only sell, 100 lots in Bank Nifty. 100 * 20 * 10 rs option can give only 20k which is 0.2% return.— Sunder (@SunderjiJB) January 4, 2020

5. Penny Option Sellers may be out of the industry.

6. Workshops based on Weekly Options / Expiry trading may be no more.

2/

January 3, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.5% in negative at 12227

- AD was flat (good sign)

- VIX up 10% (bad sign)

- NIFTY PE 28% (bad sign)

- trend is up on daily charts

- today nifty closed 0.5% in negative at 12227

- AD was flat (good sign)

- VIX up 10% (bad sign)

- NIFTY PE 28% (bad sign)

January 2, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.8% in positive at 12283

- AD was 13:5

- highest OI at 12000 CE (monthly expiry)

- next weekly expiry OI is congested around 12200 CE-12300 PE

- trend is up on daily charts

- today nifty closed 0.8% in positive at 12283

- AD was 13:5

- highest OI at 12000 CE (monthly expiry)

- next weekly expiry OI is congested around 12200 CE-12300 PE

January 1, 2020

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 12190

- AD was 10:7

- highest OI at 12300 CE...limited upside

- 12200-12000 to provide support

- trend is up on daily charts

- today nifty closed flat at 12190

- AD was 10:7

- highest OI at 12300 CE...limited upside

- 12200-12000 to provide support

Subscribe to:

Posts (Atom)