August 31, 2019

Just love the way every single media house is magnifying this bad news.

Just love the way every single media house is magnifying this bad news. https://t.co/qElEppgLCi— Eclectic Investor (@eclecticinvestr) August 31, 2019

Get ready to say good bye to $5 trillion economy

Get ready to say good bye to ₹ 5 trillion if no new economic policy is forthcoming. Neither boldness alone or knowledge alone can save the economy from a crash. It needs both. Today we have neither— Subramanian Swamy (@Swamy39) August 31, 2019

August 30, 2019

On judging someone by what they don't have

No, no, no. You can always judge a person by their "lack of" bookshelf. https://t.co/8WlfgBd6kP— V. Anand | வெ. ஆனந்த் (@iam_anandv) August 30, 2019

Market outlook

Daily charts:

- trend is down and will reverse on close above 11200

- today nifty closed 0.7% in positive

- AD was 10:7

- today was a volatile day

- intraday swing (up and down) was 300 points

- AD was however flat even when nifty was down

- one could see buying in midcap/ small cap stocks

- so bias was slowly turning bullish near day's low

- today upstox charts were not working in first half of the day

- a crude H&S is forming and will be complete once NF closes above 11200

- this month net move in nifty is 40 points

- but swings were 200 points +/- from 11000 level

- trend is down and will reverse on close above 11200

- today nifty closed 0.7% in positive

- AD was 10:7

- today was a volatile day

- intraday swing (up and down) was 300 points

- AD was however flat even when nifty was down

- one could see buying in midcap/ small cap stocks

- so bias was slowly turning bullish near day's low

- today upstox charts were not working in first half of the day

- a crude H&S is forming and will be complete once NF closes above 11200

- this month net move in nifty is 40 points

- but swings were 200 points +/- from 11000 level

Message from Smart Money to Retail Investors

🔴🔴 Message from Smart Money to Retail Investors:— Nitin Bhatia (@nitinbhatia121) August 30, 2019

"Thank you for providing us the PROFITABLE EXIT at higher level..We knew that only you were excited and bullish about stimulus package...Please keep supporting us in Future also 🙏🙏🙏"

When the politically impossible becomes the politically inevitable

The economy has slowed. Now that there is a consensus on that, the debate has moved to how severe it is, how long it can last, and where the intervention needs to be. Like a snowball that grows bigger as it rolls on, economic momentum builds in a certain direction till a force (intervention) is applied. The later the response, the stronger the necessary intervention.

This amplification of the prevailing trend plays out on several fronts. Let us start with financial conditions. Once financing conditions tightened after the default by a large financial firm about a year back, the resultant economic weakness pushed more firms into default.

For a few quarters, private financial firms that had the potential to grow took advantage of the lack of competition and grew their loan-books profitably. But now, as the underlying issues stayed unresolved and growth has weakened further, afraid of new bad loans, even they are slowing down credit disbursement. This is now likely to cause the next round of weakness.

Read more at https://indianexpress.com/article/opinion/columns/seize-the-economy-slowdown-5949149/

This amplification of the prevailing trend plays out on several fronts. Let us start with financial conditions. Once financing conditions tightened after the default by a large financial firm about a year back, the resultant economic weakness pushed more firms into default.

For a few quarters, private financial firms that had the potential to grow took advantage of the lack of competition and grew their loan-books profitably. But now, as the underlying issues stayed unresolved and growth has weakened further, afraid of new bad loans, even they are slowing down credit disbursement. This is now likely to cause the next round of weakness.

Read more at https://indianexpress.com/article/opinion/columns/seize-the-economy-slowdown-5949149/

NHAI’s Giant Liabilities: Is There a Solution That Doesn't Tax Us More?

NHAI’s gigantic debt, contingent liabilities, stalled projects and web of litigation across the country, are turning into the biggest roadblock to infrastructure development. Union minister Nitin Gadkari has ignored this for five years, even as he criss-crossed the country announcing mega projects with massive outlays. Reports that the prime minister’s office (PMO) has rapped the ministry for extensive and ‘reckless’ highway expansion, finally, led to a much-needed public discussion last week.

NHAI has reportedly been asked to discontinue construction of roads and monetise assets; this has happened only after NHAI’s debt soared from Rs40,000 crore in 2014 to an unsustainable Rs1.78 lakh crore in 2019 under Mr Gadkari’s watch.

Read more at https://www.moneylife.in/article/nhais-giant-liabilities-is-there-a-solution-that-doesnt-tax-us-more/58045.html

NHAI has reportedly been asked to discontinue construction of roads and monetise assets; this has happened only after NHAI’s debt soared from Rs40,000 crore in 2014 to an unsustainable Rs1.78 lakh crore in 2019 under Mr Gadkari’s watch.

Read more at https://www.moneylife.in/article/nhais-giant-liabilities-is-there-a-solution-that-doesnt-tax-us-more/58045.html

August 29, 2019

The government has no business to be in business

.@nayyardhiraj: India should follow 3 do-no-harm principles.— Milan Vaishnav (@MilanV) August 29, 2019

1. Wealth creation is a national service

2. The government has no business to be in business

3. The government should ensure ease of doing business and ease of living of citizenshttps://t.co/wuszCmnNPC

We forget old predictions and want new ones

Market predictions...... Which have we missed any?— L. (@larissafernand) August 29, 2019

June 2020 = 45,000

Morgan Stanley on Sensex

2030 = 125,000

Rakesh Jhunjhunwala on Nifty

2020 = 1,00,000

Varun Goel of Karvy on Sensex https://t.co/r2NBUobTWM

Ask your guru to trade in front of you

#mainebolatha trading gurus showing WhatsApp messages after trading hours .— Subhadip Nandy (@SubhadipNandy) August 29, 2019

Ask the guru to trade in front of you , ask him to trade with you . That's the only way to ascertain a trader from a faker 😋 https://t.co/gedOAj7B88

Market outlook

Daily charts:

- trend is down on daily charts

- today markets closed 0.9% in negative at 10948

- AD was 7:12

- my hopes of H&S are playing out so far

- for completion, nifty should form a higher swing low and

- then break out above 11200

- till then, this is just talk

- trend is down on daily charts

- today markets closed 0.9% in negative at 10948

- AD was 7:12

- my hopes of H&S are playing out so far

- for completion, nifty should form a higher swing low and

- then break out above 11200

- till then, this is just talk

Weird datafeed problems

- about a minute of market open, nifty futures showed a low 10805

- this did not happen on the first tick but much later

- data integrity is seriously in doubt

- see the charts... sends everything for a toss

- but broker charts were clean

- no point in complaining to NSE

- per NSE any move within circuit range is fine.

- this issue was active on twitter also

- OI figures were not being updated on NSE site

- this did not happen on the first tick but much later

- data integrity is seriously in doubt

- see the charts... sends everything for a toss

- but broker charts were clean

- no point in complaining to NSE

- per NSE any move within circuit range is fine.

- this issue was active on twitter also

- OI figures were not being updated on NSE site

This is ridiculous

One of the finest novels and a classic ever written "War and Peace" by Leo Tolstoy... cannot be kept at home.

You might be considered antinational...

Read more here

You might be considered antinational...

Read more here

August 28, 2019

Swiss bank nahi toh RBI sahi

Everyone was waiting for BJP to bring money from Swiss Bank.— P R Sundar (@PRSundar64) August 28, 2019

Instead they brought money from Reserve Bank.

😀😀😀

Market outlook

Daily charts:

- trend is down on daily charts

- today markets closed 0.5% in negative at 11046

- AD was 7:11

- markets could not cross prev day's high

- markets broke prev day's low but recovered sharply

- support is emerging around 10990-11000 range

- trend is down on daily charts

- today markets closed 0.5% in negative at 11046

- AD was 7:11

- markets could not cross prev day's high

- markets broke prev day's low but recovered sharply

- support is emerging around 10990-11000 range

August 27, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.4% in positive at 11105

- AD was 13:5 (or slightly better than 2:1)

- stiff resistance around 11200

- how about an H&S forming with neckline at 11200?

- right hand shoulder (RHS) is yet to be formed

- but no harm in just guessing

- RHS formation would mean another decline leading to higher swing low

- trend is down on daily charts

- today nifty closed 0.4% in positive at 11105

- AD was 13:5 (or slightly better than 2:1)

- stiff resistance around 11200

- how about an H&S forming with neckline at 11200?

- right hand shoulder (RHS) is yet to be formed

- but no harm in just guessing

- RHS formation would mean another decline leading to higher swing low

Where can you get trapped?

Don't just memorize patterns that everyone can see and are still coin flips— 24 x 7 x 365 Days (@BrainandMoney) August 27, 2019

Instead, ask yourself

Where are the traps?

What is the path of least resistance?

Where will losers have to cut their losses and how can I plan to take advantage of this information?

Open positions and stoploss

| Stock | Close | % Change | Bought at | Buy Date | Remarks | Trailing Stoploss | Returns % |

| ASIANPAINT | 1597.55 | 1.09 | 1566 | 06/08/2019 | Hold long positions | 1550 | 2.02 |

| AUROPHARMA | 590.00 | -1.38 | 598 | 08/08/2019 | Hold long positions | 560 | -1.34 |

| BAJAJ-AUTO | 2736.80 | -0.45 | 2601 | 02/08/2019 | Hold long positions | 2650 | 5.24 |

| COLPAL | 1201.35 | 0.84 | 1210 | 08/08/2019 | Hold long positions | 1180 | -0.70 |

| DMART | 1531.05 | 4.14 | 1451 | 09/08/2019 | Hold long positions | 1450 | 5.53 |

| HCLTECH | 1092.85 | 0.54 | 1088 | 08/08/2019 | Hold long positions | 1040 | 0.42 |

| HEROMOTOCO | 2590.95 | -1.87 | 2469 | 06/08/2019 | Hold long positions | 2550 | 4.96 |

| KOTAKBANK | 1512.80 | 2.90 | 1485 | 06/08/2019 | Hold long positions | 1445 | 1.85 |

| PIDILITIND | 1386.35 | 1.96 | 1309 | 06/08/2019 | Hold long positions | 1325 | 5.93 |

| SBILIFE | 827.10 | 0.71 | 787 | 06/08/2019 | Hold long positions | 770 | 5.07 |

| TATAGLOBAL | 269.05 | 1.17 | 271 | 06/08/2019 | Hold long positions | 255 | -0.55 |

| TCS | 2276.30 | 1.27 | 2258 | 08/08/2019 | Hold long positions | 2140 | 0.81 |

NIFTY alert by @Zafargs79

#NIFTY #Alert— Zafar Shaikh (@Zafargs79) August 26, 2019

Broken DownSloping Resistance Line!

Close Above 11000 Wud Indicate Strength & Temporary Arrest of Downtrend!

11100 Is Small Resistance & Possibility of TL Retest Once Momentum Is Exhuasted

If Close Above 11000, Then 11250-11350 Likely In Next Few Sessions! pic.twitter.com/LSQbMubSFP

August 26, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- I will call trend as up once it closes above 11200 (swing high)

- this is for sake of consistency

- Friday was a bullish piercing pattern

- this called up for a big gap up which happened today

- the following sell off caused a 300 points wild swing

- the close near day's high

- very good chances of 11200 being taken out

- I am already hearing talks of 12000 being taken out!

- only problem is nifty OI shows short covering and not long buildup.

- the swing gave an excellent opportunity for bulls and bears to profit

- sadly, it also would have caused huge losses to the disciplined trader

- I know people who were long on the first bar and some others who shorted after 100/ 150 points fall

- today's pattern is "hanging man" ... this is bearish

- this pattern is important only after a strong rally last 8-10 or 10-15 days

- this is not the case this time so we can safely assume rally will continue

- today's close was at 11057 (2% positive)

- AD was 2:1

- trend is down on daily charts

- I will call trend as up once it closes above 11200 (swing high)

- this is for sake of consistency

- Friday was a bullish piercing pattern

- this called up for a big gap up which happened today

- the following sell off caused a 300 points wild swing

- the close near day's high

- very good chances of 11200 being taken out

- I am already hearing talks of 12000 being taken out!

- only problem is nifty OI shows short covering and not long buildup.

- the swing gave an excellent opportunity for bulls and bears to profit

- sadly, it also would have caused huge losses to the disciplined trader

- I know people who were long on the first bar and some others who shorted after 100/ 150 points fall

- today's pattern is "hanging man" ... this is bearish

- this pattern is important only after a strong rally last 8-10 or 10-15 days

- this is not the case this time so we can safely assume rally will continue

- today's close was at 11057 (2% positive)

- AD was 2:1

Compounding happens too slowly...

Compounding: happens too slow to notice, makes too big a difference to ignore. https://t.co/kkmUMa3UdP pic.twitter.com/fxvF6Ux721— Morgan Housel (@morganhousel) August 25, 2019

August 25, 2019

Salary is nothing but a subscription amount

+💯 My employer unsubscribed me at the age of 54 due to financial mismanagement and resulting insolvency. Fortunately, my savings, simple lifestyle and being debt free helped me survive without further subscription and remain financially independent. https://t.co/nqYbdGAhcu— Raj Menon (@rajwiladi) August 24, 2019

August 24, 2019

2 new words....

Two words which are used so much now a days, but have not heard during Congress period.— P R Sundar (@PRSundar64) August 24, 2019

1. Bakht.

2. Anti National.

😀😀😀

August 23, 2019

Short covering - futures OI analysis

ADANIPOWER - AMARAJABAT - ARVIND - ASHOKLEY - BANKINDIA - BEL - BIOCON - BPCL - CANBK - CENTURYTEX - CHOLAFIN - COALINDIA - ENGINERSIN - ESCORTS - GAIL - GLENMARK - GMRINFRA - GRASIM - HDFC - HINDALCO - IDEA - IDFCFIRSTB - INDIGO - IOC - JINDALSTEL - JSWSTEEL - LICHSGFIN - MANAPPURAM - MCDOWELL_N - MCX - MFSL - MGL - MUTHOOTFIN - NBCC - NCC - OIL - PAGEIND - PEL - PNB - PVR - RAMCOCEM - RBLBANK - RELIANCE - RELINFRA - SAIL - SUNPHARMA - TATAELXSI - TATAGLOBAL - TATAMOTORS - TATAPOWER - TATASTEEL - TITAN - UBL - UNIONBANK - UPL - VEDL - ZEEL

Finally the FM blinks

Aug 23, 05:38 PM (IST)

It has been decided that enchanced surcharge levied on long term and short term capital gains on equities goes, said FM Sitharman.

Aug 23, 5:45 PM (IST)

Banks have agreed to pass on all Repo Rate cuts into their MCLR, said FM Sitharaman.

Aug 23, 5:44 PM (IST)

An additional capital of Rs 70,000 crore has been sanctioned for banks, which will enable loans worth Rs 5 lakh crore, said FM Sitharaman.

Aug 23, 05:42 PM (IST)

Section 56 2(b) Of I-T Act not to be applicable for startups registered with DPTIT, said FM Sitharaman.

Aug 23, 05:41 PM (IST)

The surcharge on FPIs and domestic investors goes, says Finance Minister

Aug 23, 05:37 PM (IST)

All assessments will be cleared in three months, said FM Sitharaman.

Aug 23, 05:36 PM (IST)

Issue of I-T orders, summons and letters etc shall now go through a centralised system from October 1, said FM Sitharaman.

Read more at https://www.moneycontrol.com/news/business/fm-nirmala-sitharaman-press-conference-live-updates-finance-minister-expected-to-address-fpi-surcharge-issue-4366441.html

It has been decided that enchanced surcharge levied on long term and short term capital gains on equities goes, said FM Sitharman.

Aug 23, 5:45 PM (IST)

Banks have agreed to pass on all Repo Rate cuts into their MCLR, said FM Sitharaman.

Aug 23, 5:44 PM (IST)

An additional capital of Rs 70,000 crore has been sanctioned for banks, which will enable loans worth Rs 5 lakh crore, said FM Sitharaman.

Aug 23, 05:42 PM (IST)

Section 56 2(b) Of I-T Act not to be applicable for startups registered with DPTIT, said FM Sitharaman.

Aug 23, 05:41 PM (IST)

The surcharge on FPIs and domestic investors goes, says Finance Minister

Aug 23, 05:37 PM (IST)

All assessments will be cleared in three months, said FM Sitharaman.

Aug 23, 05:36 PM (IST)

Issue of I-T orders, summons and letters etc shall now go through a centralised system from October 1, said FM Sitharaman.

Read more at https://www.moneycontrol.com/news/business/fm-nirmala-sitharaman-press-conference-live-updates-finance-minister-expected-to-address-fpi-surcharge-issue-4366441.html

Unprecedented financial sector crisis in 70 years, says NITI Aayog

Government think tank NITI Aayog on Thursday described the current stress in the financial sector as “unprecedented in the last 70 years”, saying nobody is trusting anyone else in the sector. It made a case for extraordinary steps to deal with the crisis that has resulted in an economic slowdown.

NITI Aayog Vice-Chairman Rajiv Kumar also said there was no business of the government to hold back payments to companies.

“Nobody is trusting anybody else... within the private sector nobody is ready to lend, everyone is sitting on cash... you may have to take steps that are extraordinary,” Kumar said.

Read more at https://www.business-standard.com/article/economy-policy/unprecedented-financial-sector-crisis-in-70-years-says-niti-aayog-119082300053_1.html

NITI Aayog Vice-Chairman Rajiv Kumar also said there was no business of the government to hold back payments to companies.

“Nobody is trusting anybody else... within the private sector nobody is ready to lend, everyone is sitting on cash... you may have to take steps that are extraordinary,” Kumar said.

Read more at https://www.business-standard.com/article/economy-policy/unprecedented-financial-sector-crisis-in-70-years-says-niti-aayog-119082300053_1.html

3 biggest achievements of BJP

3 biggest achievements of BJP.— P R Sundar (@PRSundar64) August 22, 2019

1. Triple talaq abolished.

2. Article 370 abolished.

3. Stock market abolished.

😜😜😜

August 22, 2019

Market outlook + multiple timeframe charts

Daily charts:

- trend has turned down today

- there was a strong hint yesterday when nifty closed below 11000 the 2nd time

- last trend change was up on 8-AUG (11032)

- trollers: net loss is 300 points or less than 3% [.03% of capital if you do risk mgmt]

- today nifty closed below 10800... recent swing low

- close was at 10738 down 1.7%

- AD was 1:7

- next support 10600 and then 10000

- resistance/ swing high 11200

- today 490 stocks closed at 52 week low

- small caps index lost 3%... real blood bath here

- trend has turned down today

- there was a strong hint yesterday when nifty closed below 11000 the 2nd time

- last trend change was up on 8-AUG (11032)

- trollers: net loss is 300 points or less than 3% [.03% of capital if you do risk mgmt]

- today nifty closed below 10800... recent swing low

- close was at 10738 down 1.7%

- AD was 1:7

- next support 10600 and then 10000

- resistance/ swing high 11200

- today 490 stocks closed at 52 week low

- small caps index lost 3%... real blood bath here

The cash crunch gets worse

This is scary or not ?https://t.co/U8wE06K1rE— 24 x 7 x 365 Days (@BrainandMoney) August 22, 2019

August 21, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed 0.9% in negative at 10919

- AD was 4:13 ... not good

- today 300+ stocks made new 52 week lows

- trend is up on daily charts

- today markets closed 0.9% in negative at 10919

- AD was 4:13 ... not good

- today 300+ stocks made new 52 week lows

Serious cash crunch due to an underperforming GST?

The clearest indicator that something has gone terribly wrong with the flawed #GST.— SonaliRanade (@sonaliranade) August 21, 2019

The divergence between direct & indirect taxes is “proof” with a few caveats. pic.twitter.com/G4CGf7vNjs

..............What is driving this slowdown of the Union government: poor tax collection. The Centre’s share of taxes was 7.3% of the Indian GDP in 2013-’14. By 2018-’19 that number had dipped to 6.9%.

Like in the case of expenditure, there is also the problem of unpredictability. The estimated central government share of taxes as a percentage of GDP at the start of 2018-’19 was 7.9%. But it fell by a whole percentage point when actual taxes were counted up at the end of the financial year. This gap between estimates and actuals was the highest ever in India’s tax history and sent alarm bells ringing in the Union government.

The largest ever gap between estimates and actuals points to a fairly disconcerting state of affairs. How did things come to such a pass?

Read complete article at https://scroll.in/article/934066/in-charts-the-modi-government-is-facing-a-serious-cash-crunch-thanks-to-gst

Social Media Accounts Should be Aadhaar-Linked in 'National Interest': Govt's Top Law Officer Tells SC

My notes:

- government view is you are guilty till proven innocent

- government wants to play nanny to you because you don't know what is good for you

- expect a huge drop in number of trollers

- expect a rise in fake news linked to fraudulently obtained Aadhaar numbers.

- will whatsapp, twitter quit India?

Read more at https://www.news18.com/news/india/govts-top-law-officer-tells-sc-social-media-accounts-should-be-linked-with-aadhaar-in-national-interest-2277055.html

- government view is you are guilty till proven innocent

- government wants to play nanny to you because you don't know what is good for you

- expect a huge drop in number of trollers

- expect a rise in fake news linked to fraudulently obtained Aadhaar numbers.

- will whatsapp, twitter quit India?

Read more at https://www.news18.com/news/india/govts-top-law-officer-tells-sc-social-media-accounts-should-be-linked-with-aadhaar-in-national-interest-2277055.html

On being a hero

Mad respect for Cathay Pacific CEO Rupert Hogg. pic.twitter.com/h2eUvi9BVv— Ray[REDACTED] (@RayRedacted) August 20, 2019

August 20, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.3% in negative at 11017

- AD was 1:2

- this month, nifty is trading between 10800 and 11200

- but actual net move on closing basis shows no progress

- net move so far is less than 1%

- trend is up on daily charts

- today nifty closed 0.3% in negative at 11017

- AD was 1:2

- this month, nifty is trading between 10800 and 11200

- but actual net move on closing basis shows no progress

- net move so far is less than 1%

Indian jugaad at its best

HeroHonda #Japan will hire this engineer pic.twitter.com/gwml4KPzfg— 24 x 7 x 365 Days (@BrainandMoney) August 20, 2019

August 19, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 11054

- AD was 5:4

- master candle formed on 13-AUG

- high low is 11145 - 10900

- trend is up on daily charts

- today nifty closed flat at 11054

- AD was 5:4

- master candle formed on 13-AUG

- high low is 11145 - 10900

August 18, 2019

August 17, 2019

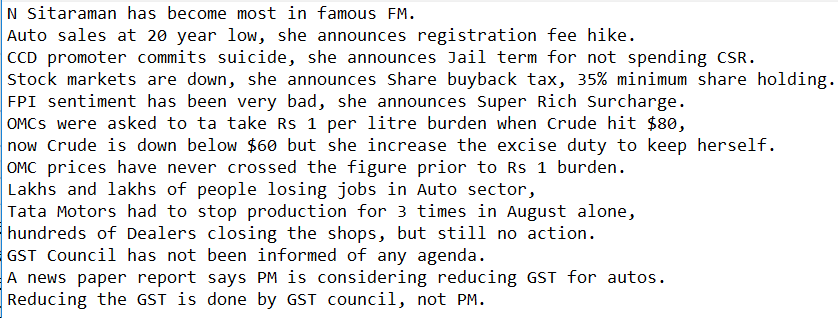

All talk no action in FM and let the economy be damned

Yesterday I was confused by some news report.— P R Sundar (@PRSundar64) August 16, 2019

Now I am clear.

They are just, "talking"https://t.co/nZI9wFlxIH

I'm confused.— D.Muthukrishnan (@dmuthuk) August 16, 2019

Last one week ET has been saying something or other about stimulus from PM and FM.

Now government wants to take inputs from all PSB branches across the country on how to achieve $5 trillion economy.

Is this how these things are done?https://t.co/g8BiXzoVK7

August 16, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed marginally in positive at 11048

- AD was flat

- support is slowly shifting up from 10800 to 10900

- above 11200, rally of 200-300 points possible

- trend is up on daily charts

- today nifty closed marginally in positive at 11048

- AD was flat

- support is slowly shifting up from 10800 to 10900

- above 11200, rally of 200-300 points possible

Next GDP to include "monetary value of cooking at home"?

Careful there. Before you know it, the next GDP estimate will show that Indian grew at 30%, because the "monetary value of cooking at home" will be added. It will be spun as we are correcting a historical gender injustice etc. etc and even skeptics will be forced to accept it. https://t.co/Ta3gzdU0p4— V. Anand | வெ. ஆனந்த் (@iam_anandv) August 16, 2019

August 15, 2019

August 14, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 1% in positive at 11029

- AD was flat

- VIX dropped 8%

- trend is up on daily charts

- today nifty closed 1% in positive at 11029

- AD was flat

- VIX dropped 8%

August 13, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 1.7% in negative at 10925

- AD was 1:2 (not bad)

- 160 stocks made new 52 week lows (good sign as number usually is 500+)

- there was a hint of correction when markets did not close near day;s high Friday

- today we had a big bar

- this usually means expect correction to continue

- but I said trend is up 2 days ago on 8-AUG (11032)

- now SL is 10800 spot for this notional trade

- in hindsight, correct swing high should have been 11200 and not 11000

- will 10800 break?

- if 10800 breaks, will 10000 be visited?

- what if this is the last leg of the correction? hint...market breadth

- VIX up 14%

- this might mean more pain?

- today RELIANCE was up 10% on good news

- this stock is an index heavyweight and weight is 9%

- if this stock was flat today, index would have been down another 190 points

- try the nifty replica to see how heavyweights influence index

- USDINR is playing havoc with the market - https://www.tradingview.com/x/Yp2HizJh/

- trend is up on daily charts

- today nifty closed 1.7% in negative at 10925

- AD was 1:2 (not bad)

- 160 stocks made new 52 week lows (good sign as number usually is 500+)

- there was a hint of correction when markets did not close near day;s high Friday

- today we had a big bar

- this usually means expect correction to continue

- but I said trend is up 2 days ago on 8-AUG (11032)

- now SL is 10800 spot for this notional trade

- in hindsight, correct swing high should have been 11200 and not 11000

- will 10800 break?

- if 10800 breaks, will 10000 be visited?

- what if this is the last leg of the correction? hint...market breadth

- VIX up 14%

- this might mean more pain?

- today RELIANCE was up 10% on good news

- this stock is an index heavyweight and weight is 9%

- if this stock was flat today, index would have been down another 190 points

- try the nifty replica to see how heavyweights influence index

- USDINR is playing havoc with the market - https://www.tradingview.com/x/Yp2HizJh/

You can borrow a system but not the conviction

You cannot Trade any system, no matter how good, without conviction. And conviction is impossible to come by unless you have extensively worked on the system. https://t.co/Faqw1vBFOM— Pran Katariya (@KatariyaPran) August 13, 2019

August 12, 2019

RELIANCE chart

Why is #RELIANCE suddenly trending on twitter?

Meanwhile, another chart and some more views

Meanwhile, another chart and some more views

— yogesh (@akashizepghe) August 10, 2019

And while RIL planning to repay debt of Rs 1 lakh crore, FM is planning to borrow Rs 1 lakh crore from abroad.— P R Sundar (@PRSundar64) August 12, 2019

😀😀😀

Interesting data which suggests 5 to 6% upside for Nifty by end of August.

Interesting data which suggests 5 to 6% upside for Nifty by end of August. pic.twitter.com/h8LIFVCYxk— P R Sundar (@PRSundar64) August 12, 2019

August 11, 2019

Is mAadhaar worst android app?

One of the world's most well known ethical hacker makes this a topic at Defcon .... UIDAI hates him no end.

DEF CON is one of the world's largest hacker conventions, held annually in Las Vegas. Attendees include computer security professionals, journalists, lawyers, federal government employees, security researchers, students, and hackers with a general interest in software, computer architecture, hardware modification, and anything else that can be "hacked". The event consists of several tracks of speakers about computer- and hacking-related subjects, as well as cyber-security challenges and competitions (known as hacking wargames). Contests held during the event are extremely varied, and can range from creating the longest Wi-Fi connection (aircrack-ng) to finding the most effective way to cool a beer in the Nevada heat.

Talk repetition: done, time for party!— Elliot Alderson (@fs0c131y) August 11, 2019

My talk will be at 10am at the @AppSecVillage, if you are at #defcon or from the #Indian government you should come 😉 pic.twitter.com/1ldBEP1zQ4

DEF CON is one of the world's largest hacker conventions, held annually in Las Vegas. Attendees include computer security professionals, journalists, lawyers, federal government employees, security researchers, students, and hackers with a general interest in software, computer architecture, hardware modification, and anything else that can be "hacked". The event consists of several tracks of speakers about computer- and hacking-related subjects, as well as cyber-security challenges and competitions (known as hacking wargames). Contests held during the event are extremely varied, and can range from creating the longest Wi-Fi connection (aircrack-ng) to finding the most effective way to cool a beer in the Nevada heat.

August 9, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.7% in positive at 11110

- AD was almost 2:1

- inverted hammer formed

- ignoring this right now as trend is too small/ short

- otherwise implication in bearish

- next week, 2 holidays

- Monday and Thursday

- trend is up on daily charts

- today nifty closed 0.7% in positive at 11110

- AD was almost 2:1

- inverted hammer formed

- ignoring this right now as trend is too small/ short

- otherwise implication in bearish

- next week, 2 holidays

- Monday and Thursday

August 8, 2019

Market outlook

Daily charts:

- trend is up on daily charts (wef today)

- markets closed above swing high defined yesterday

- today's close was 1.6% in positive at 11032

- new swing low defined at 10800

- AD was 10:7

- see hourly chart for channel

NOTE:

- the fall from 11700 to 10800 has been without any pause

- is a bottom is formed for this year or is a pullback rally happening? I don't know

- a slower upmove from here can mean the bigger correction will resume later on

- another possibility is a rally max to 11500 which then stalls

- trade accordingly with your stops in place

- trend is up on daily charts (wef today)

- markets closed above swing high defined yesterday

- today's close was 1.6% in positive at 11032

- new swing low defined at 10800

- AD was 10:7

- see hourly chart for channel

NOTE:

- the fall from 11700 to 10800 has been without any pause

- is a bottom is formed for this year or is a pullback rally happening? I don't know

- a slower upmove from here can mean the bigger correction will resume later on

- another possibility is a rally max to 11500 which then stalls

- trade accordingly with your stops in place

August 7, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.8% negative at 10855

- AD was flat (good sign)

- today only 166 stocks made new 52 week lows

- this is a good sign

- small swing high formed and identified around 11000

- only problem is VIX was up 5% today/ not coming down at all

- trend is down on daily charts

- today nifty closed 0.8% negative at 10855

- AD was flat (good sign)

- today only 166 stocks made new 52 week lows

- this is a good sign

- small swing high formed and identified around 11000

- only problem is VIX was up 5% today/ not coming down at all

August 6, 2019

Subscribe to:

Posts (Atom)