July 31, 2016

July 30, 2016

July 29, 2016

How Many Stocks Should You Own?

Is 10 the right number of stocks to own?

Is 20 the right number?

Is it 50…or 100?

The number of stocks you own has a huge effect on your performance. In this essay, I’ll walk you through my thinking on this critical topic. I hope it helps you make great decisions with your own portfolio.

How the Pareto Principle Can Make You Wealthy

Read more at https://katusaresearch.com/how-many-stocks-should-you-own

Is 20 the right number?

Is it 50…or 100?

The number of stocks you own has a huge effect on your performance. In this essay, I’ll walk you through my thinking on this critical topic. I hope it helps you make great decisions with your own portfolio.

How the Pareto Principle Can Make You Wealthy

Read more at https://katusaresearch.com/how-many-stocks-should-you-own

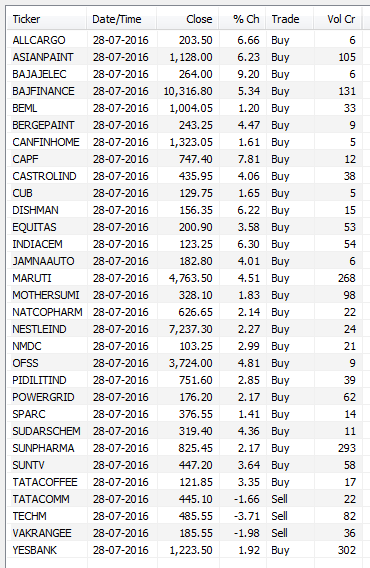

July 28, 2016

July 27, 2016

July 26, 2016

Mid-Cap Stocks Valuation signals danger

The valuation of mid-cap stocks is at its highest since early 2008, when Indian markets were at their peak, and tumbled soon after.

Source: http://alphaideas.in/2016/07/26/chart-mid-cap-stocks-valuation-highest-since-jan-2008/

Source: http://alphaideas.in/2016/07/26/chart-mid-cap-stocks-valuation-highest-since-jan-2008/

July 25, 2016

Neowave analysis by Vivek Patil

....

strength sustaining above the 9-day range could invalidate ET argument. In such a case, the better label for last week’s pause would be “x”, which would turn post-Brexit rally into a Double.

And, on one higher degree, the entire post-Brexit rally consisting of the Double Combination would be considered as “a” leg of the larger 2nd Corrective which opened after Brexit.

All in all, watch the 9-day range as a crucial zone in the Expiry week. Strength sustaining above the range would continue the rally, but top of “B” would be the next crucial level to determine the variation of Expanding Triangle applicable.

Read more at http://content.icicidirect.com/ULFiles/UploadFile_2016725104610.asp

strength sustaining above the 9-day range could invalidate ET argument. In such a case, the better label for last week’s pause would be “x”, which would turn post-Brexit rally into a Double.

And, on one higher degree, the entire post-Brexit rally consisting of the Double Combination would be considered as “a” leg of the larger 2nd Corrective which opened after Brexit.

All in all, watch the 9-day range as a crucial zone in the Expiry week. Strength sustaining above the range would continue the rally, but top of “B” would be the next crucial level to determine the variation of Expanding Triangle applicable.

Read more at http://content.icicidirect.com/ULFiles/UploadFile_2016725104610.asp

July 24, 2016

A statistical analysis of failures

So why does almost everyone believe that one needs a perfect hit rate to achieve good returns? This myth is quite common as one can see from comments in the media, where people are surprised when some well-known investor has a losing position.

I think it speaks to the ignorance of the following points

- A losing position has a downside of 100% at the most, but a winning position can go up much more than that and cover for several such losses. Let’s say you have a portfolio of three stocks and two go to 0, but the third stock is a 5 bagger. Even in such an extreme example, the investor has increased his portfolio by 50% with equal weightage in all the three positions.

- Let’s take the previous example again and instead of equal weightage, let’s say the two failed position were only 10% of the portfolio, whereas the winning position was 90%. In such a happy scenario, the overall portfolio is up 4.5X.

Read complete article at http://valueinvestorindia.blogspot.in/2016/07/a-statistical-analysis-of-failures.html

I think it speaks to the ignorance of the following points

- A losing position has a downside of 100% at the most, but a winning position can go up much more than that and cover for several such losses. Let’s say you have a portfolio of three stocks and two go to 0, but the third stock is a 5 bagger. Even in such an extreme example, the investor has increased his portfolio by 50% with equal weightage in all the three positions.

- Let’s take the previous example again and instead of equal weightage, let’s say the two failed position were only 10% of the portfolio, whereas the winning position was 90%. In such a happy scenario, the overall portfolio is up 4.5X.

Read complete article at http://valueinvestorindia.blogspot.in/2016/07/a-statistical-analysis-of-failures.html

Trading as a way of life - nice video

Bowes-Little grew up in San Francisco. He gained a scholarship to Brown University in Providence, Rhode Island where he studied philosophy and economics, and later studied at the London School of Economics.

Bowes-Little's first career was as a professional basketball player, after which he worked as a trader for investment banks in New York and London, including the position of vice president, credit trading at Goldman Sachs, while pursuing a second career as a hip hop artist and poet in the evenings since 2007 under the name Metis (a reference to the Greek language, which he describes as "perceiving the true essence of things").

He has written an autobiography, The Trade, which has been picked up by a literary agent and with which he has tried to interest Hollywood directors with a view to turning it into a film.

July 22, 2016

July 21, 2016

Market outlook - has the market topped out?

Daily charts

- today we had a high formed in NF fut around 8888 levels... 300 points above the normal

- in a separate post, I have hinted this means dabba operators expect markets to come down

- note today's open/ high in future ... this effectively stops out all dabba traders having a short position

And this is how the open interest figures look like... limited upside!

5 min charts... posted for reference only

- the entire perspective is messed up

- today we had a high formed in NF fut around 8888 levels... 300 points above the normal

- in a separate post, I have hinted this means dabba operators expect markets to come down

- note today's open/ high in future ... this effectively stops out all dabba traders having a short position

And this is how the open interest figures look like... limited upside!

5 min charts... posted for reference only

- the entire perspective is messed up

History suggests leaving Europe is great for Britain

The almost universal disdain for what Britain did on June 23 is based on four mistaken perceptions. First, most people seem to believe that the country voted against free trade and globalization. This voters did not do. They voted against being members of the European Union (EU), an institution bent on creating something like the United States of Europe, establishing a common European sovereignty over all its members. Voters have not said that they want to isolate Britain. On the contrary, they have said that they want to remain a globalized country and very close to Europe.

Second, most people got the impression that the voters who wanted to get out of the EU were primarily manual laborers, people with lower-than-average education, those who live outside fashionable London, and the elderly. This characterization is not entirely true. Many young, well-educated, fashionable Londoners and southerners voted Leave. Moreover, in any case, the implied idea that the opinions of voters who fall into the former categories should somehow be disqualified is relevant only if the decision had been made not in a full democracy but in one in which the votes of the younger, richer, more intellectual Londoners had extra value.

Read more at https://uk.finance.yahoo.com/news/keep-calm-brexit-history-suggests-090046436.html

Second, most people got the impression that the voters who wanted to get out of the EU were primarily manual laborers, people with lower-than-average education, those who live outside fashionable London, and the elderly. This characterization is not entirely true. Many young, well-educated, fashionable Londoners and southerners voted Leave. Moreover, in any case, the implied idea that the opinions of voters who fall into the former categories should somehow be disqualified is relevant only if the decision had been made not in a full democracy but in one in which the votes of the younger, richer, more intellectual Londoners had extra value.

Read more at https://uk.finance.yahoo.com/news/keep-calm-brexit-history-suggests-090046436.html

Could India Be the First to Get Rid of Cash?

"Black money" -- the colloquial name for a vast network of off-the-book cash transactions and unbanked savings -- is one of India's biggest scourges. Amounting to as much as $460 billion a year, bigger than the GDP of Argentina, all that money lies beyond the reach of the tax authorities, creditors and anti-corruption investigators.

Efforts to bring it into the open have struggled. Ironically, though, they may be setting up India to leapfrog past other, far more advanced economies into a future without any cash at all.

India's black money pile is unusually large for several reasons. First and foremost, about half the country's output comes from the small, informal sector, where cash transactions are the norm. Meanwhile, taxes are cumbersome to pay and easy to avoid. To collect revenue, India’s government has to rely on indirect levies such as sales and excise taxes, which are distortionary and regressive, rather than on income tax. Direct taxes contribute only 35 percent of the take in India, compared to the OECD ideal of two-thirds.

Read more at http://www.bloomberg.com/view/articles/2016-07-21/india-s-cashless-future

Efforts to bring it into the open have struggled. Ironically, though, they may be setting up India to leapfrog past other, far more advanced economies into a future without any cash at all.

India's black money pile is unusually large for several reasons. First and foremost, about half the country's output comes from the small, informal sector, where cash transactions are the norm. Meanwhile, taxes are cumbersome to pay and easy to avoid. To collect revenue, India’s government has to rely on indirect levies such as sales and excise taxes, which are distortionary and regressive, rather than on income tax. Direct taxes contribute only 35 percent of the take in India, compared to the OECD ideal of two-thirds.

Read more at http://www.bloomberg.com/view/articles/2016-07-21/india-s-cashless-future

July 20, 2016

July 19, 2016

July 18, 2016

Vivek Patil's weekly neowave analysis

...

As of now, “D” is bigger than “B”, which is required for “Expansion”. Price-wise, “D” is twice the size of “B”. The “Running” variation of Expanding Triangle would require both B-D line & A-C line to slant downwards.

This is contrast with “Horizontal” variation of Expanding Triangle, wherein B-D line should be slanting upwards and A-C line slanting downwards.

Therefore, to confirm the “Running” variation, “D” should end below the top of “B”. This would mean “D” should end below 23rd Jul’15 high of 28578 (Nifty 8655) to maintain the “Running” variation.

However, till the Index starts making lower top lower bottom below the 0-x line, which is considered as the Baseline for “D”, the short term trend would be assumed as UP as per Dow Theory (higher top higher bottom).

However, if the “D” leg crosses the top of “B”, then the structure from Mar’15 onwards could turn into “Irregular” variation, which in fact is a most common variation of Expanding Triangle variation OR a Neutral Triangle, the NEoWave details of which would be revealed next week, if required.

Read more at http://content.icicidirect.com/ULFiles/UploadFile_2016718102917.asp

As of now, “D” is bigger than “B”, which is required for “Expansion”. Price-wise, “D” is twice the size of “B”. The “Running” variation of Expanding Triangle would require both B-D line & A-C line to slant downwards.

This is contrast with “Horizontal” variation of Expanding Triangle, wherein B-D line should be slanting upwards and A-C line slanting downwards.

Therefore, to confirm the “Running” variation, “D” should end below the top of “B”. This would mean “D” should end below 23rd Jul’15 high of 28578 (Nifty 8655) to maintain the “Running” variation.

However, till the Index starts making lower top lower bottom below the 0-x line, which is considered as the Baseline for “D”, the short term trend would be assumed as UP as per Dow Theory (higher top higher bottom).

However, if the “D” leg crosses the top of “B”, then the structure from Mar’15 onwards could turn into “Irregular” variation, which in fact is a most common variation of Expanding Triangle variation OR a Neutral Triangle, the NEoWave details of which would be revealed next week, if required.

Read more at http://content.icicidirect.com/ULFiles/UploadFile_2016718102917.asp

Elliott Wave Counts of Nifty for All Time Frames as on 18 July 2016

Elliott Wave Counts of Nifty for All Time Frames as on 18 July 2016

Deepak Kumar | July 18, 2016

Today I am preparing all time frames Elliott Wave analysis report of Nifty. I was not updating longs term wave counts of Nifty because there was lack of clarity but thought of updating today as last long term analysis report I prepared 06 months back on 05 Jan 2016.

This analysis report will cover all time frame wave counts of Nifty, medium/long term outlook of Nifty and some important points useful for Elliott Wave Theory learners. So, let’s start with monthly chart.

As we know, Elliott Wave Theory is a never ending wave’s cycle starts from the birth/beginning of any financial script. Nifty born in 1995 and we need to see chart covering move from 1995 for Elliott Wave theory analysis and move from 1995 can be seen only on monthly chart. So, let’s start from the beginning.

Read more at http://sweeglu.com/elliott-wave-counts-of-nifty-for-all-time-frames-as-on-18-july-2016/

The Infosys turnaround: hype or reality?

The highly disappointing first-quarter earnings of Infosys Ltd have raised questions about claims of a turnaround under way at the company. I continue to be amused, though, at the alacrity with which sell-side analysts and excitable TV anchors/commentators rush to conclusions and create demigods out of mere mortals when the complexity of a turnaround in an increasingly complex international environment is still to be fully played out. This complex question needs to be analysed under three heads.

The highly disappointing first-quarter earnings of Infosys Ltd have raised questions about claims of a turnaround under way at the company. I continue to be amused, though, at the alacrity with which sell-side analysts and excitable TV anchors/commentators rush to conclusions and create demigods out of mere mortals when the complexity of a turnaround in an increasingly complex international environment is still to be fully played out. This complex question needs to be analysed under three heads.Firstly, an understanding of what constitutes a successful turnaround. The three phases are: fixing the structural issues (revenue, costs and organization), turning around the morale of employees and investors, and finally successfully implementing the new business model through acquisition of new revenue streams. Infosys chief executive Vishal Sikka can be credited with achieving the first two. It must be remembered, though, that when one inherits a humongous cash reserve of a few billion dollars, it is relatively easy to...

Read more at http://www.livemint.com/Opinion/psyxoJt9ZNIe0d9dhccnyK/The-Infosys-turnaround-hype-or-reality.html

Are markets overheated?

| Index Name | Closing Index Value | P/E | P/B | Div Yield |

| Nifty 50 | 8541.4 | 23.43 | 3.47 | 1.21 |

| Nifty Next 50 | 21579.4 | 27.7 | 2.98 | 1.55 |

| Nifty 100 | 8700.1 | 24.01 | 3.38 | 1.27 |

| Nifty 200 | 4499.95 | 25.04 | 3.2 | 1.25 |

| Nifty 500 | 7194.4 | 26.72 | 3.04 | 1.22 |

| Nifty Midcap 50 | 3547.65 | 49.97 | 1.79 | 1.43 |

| Nifty Free Float Midcap 100 | 14282.2 | 33.89 | 2.37 | 1.47 |

| Nifty Alpha 50 | 8878.33 | 28.39 | 3.97 | 0.61 |

| Nifty Quality 30 | 2177 | 28 | 7.17 | 1.46 |

| Nifty Full Midcap 100 | 4347.53 | 41.08 | 2.13 | 1.11 |

| Nifty Midcap 150 | 4688.28 | 36.28 | 2.52 | 1.05 |

| Nifty Smallcap 50 | 3168.04 | 39.2 | 1.16 | 1.25 |

| Nifty Full Smallcap 100 | 3062.72 | 32.76 | 1.35 | 1.1 |

| Nifty Smallcap 250 | 4673.6 | 1530.54 | 1.56 | 0.99 |

| Nifty MidSmallcap 400 | 4677 | 53.26 | 2.1 | 1.03 |

July 16, 2016

Subscribe to:

Posts (Atom)