May 31, 2016

BSE all set for an IPO

Asia’s oldest stock exchange BSE Ltd will sell up to a 30% stake before 31 March 2017 through a so-called offer for sale (OFS) with a possible fresh sale of equity tagged on, the exchange informed its shareholders on 28 May.

The exchange could raise around Rs.1,300 crore from the sale.

BSE will hold an annual general meeting (AGM) on 24 June to seek shareholder approval for the listing, which would make it the first listed stock exchange in the country.

“A combination of an offer for sale (OFS) and fresh issue, for up to a maximum of 30% of the post-issue issued equity share capital of the company, subject to regulatory requirements”, would be considered at the AGM, said the notice. A copy of the shareholder notice has been put up on the exchange’s website.

Seeking shareholder approval takes BSE a step closer to a listing. On 14 March, BSE received in-principle approval for its share sale from the Securities and Exchange Board of India (Sebi).

Read more at http://alphaideas.in/2016/05/31/bse-set-ipo/

The exchange could raise around Rs.1,300 crore from the sale.

BSE will hold an annual general meeting (AGM) on 24 June to seek shareholder approval for the listing, which would make it the first listed stock exchange in the country.

“A combination of an offer for sale (OFS) and fresh issue, for up to a maximum of 30% of the post-issue issued equity share capital of the company, subject to regulatory requirements”, would be considered at the AGM, said the notice. A copy of the shareholder notice has been put up on the exchange’s website.

Seeking shareholder approval takes BSE a step closer to a listing. On 14 March, BSE received in-principle approval for its share sale from the Securities and Exchange Board of India (Sebi).

Read more at http://alphaideas.in/2016/05/31/bse-set-ipo/

May 30, 2016

SBIN covered call writing update

- Closed short trade in 165 call as profit potential already realised

- Wrote 200 call @ average rate of Rs.8/-

- Still holding long position in delivery

Link to previous post on this topic

- Wrote 200 call @ average rate of Rs.8/-

- Still holding long position in delivery

Link to previous post on this topic

Hot stocks and charts

LAST updated: 30-MAY-2016 :: 07:42:34

- Computer generated BUY and SELL signals.

- Signals are for your study only and are completely unsuitable for trading.

- Golden stoploss: min 10% or last month's low (long position).

- Do not risk more than 1% of your capital on any trade.

- All charts are provided by icharts.in

AMBUJA CEMENTS BUY signal

May 28, 2016

AFL: Monthly crossover signals

This AFL will scan a database and generate buy/ sell signals whenever a stock closes above last month's high or below last month's low.

This is a beautiful system and can yield fantastic results if risk management is properly done.

As usual, none of my AFLs have targets so one should hold a trade with a trailing SL (last month's low for long positions).

Note: there is no volume filter so restrict your analysis / scans to the top 100-200 most liquid stocks

Here is the code:

>>>

Note:

- Run in scanner mode

- ExRem removes multiple signals.

- Refer Amibroker help file for more assistance.

This is a beautiful system and can yield fantastic results if risk management is properly done.

As usual, none of my AFLs have targets so one should hold a trade with a trailing SL (last month's low for long positions).

Note: there is no volume filter so restrict your analysis / scans to the top 100-200 most liquid stocks

Here is the code:

>>>

Buy=Cross(C,TimeFrameGetPrice("H",inMonthly,-1));

Sell=Cross(TimeFrameGetPrice("L",inMonthly,-1),C); Buy=ExRem(Buy,Sell); Sell=ExRem(Sell,Buy);

<<<

Note:

- Run in scanner mode

- ExRem removes multiple signals.

- Refer Amibroker help file for more assistance.

SBIN covered call writing

Past few months, I have been writing ATM calls in SBI while holding delivery of same quantity. This has generated a option writing income of 15K-20K per month with delivery position currently breakeven.

Now something funny happened. On the day marked with the arrow, I squared off a previous short position in 185 call at 10 paise and simultaneously sold 165 call (JUN series) at Rs.10/-.

And the markets blasted from thereon. Now this being a long series, the 165 call should have been trading around 35 but surprise of surprises, it is trading around 25. So my loss is Rs.15 in short call but there is also a notional profit of Rs.30 on delivery. Overall gain is therefore Rs.15 in 4-5 days.

Since the highest income possible in call writing is limited to the premium earned, the transaction here has generated higher profits because of fast gain in underlying and drop in IV of the stock.

This means there is no real reason to hold trade till expiry as the max profit is already available today.

Breakout above 200 will generate more upsides (20-25%) so it will make sense to trade on hourly charts next few weeks.

Now something funny happened. On the day marked with the arrow, I squared off a previous short position in 185 call at 10 paise and simultaneously sold 165 call (JUN series) at Rs.10/-.

And the markets blasted from thereon. Now this being a long series, the 165 call should have been trading around 35 but surprise of surprises, it is trading around 25. So my loss is Rs.15 in short call but there is also a notional profit of Rs.30 on delivery. Overall gain is therefore Rs.15 in 4-5 days.

Since the highest income possible in call writing is limited to the premium earned, the transaction here has generated higher profits because of fast gain in underlying and drop in IV of the stock.

This means there is no real reason to hold trade till expiry as the max profit is already available today.

Breakout above 200 will generate more upsides (20-25%) so it will make sense to trade on hourly charts next few weeks.

May 23, 2016

May 20, 2016

May 19, 2016

The S&P 500 is the World’s Largest Momentum Strategy

In many ways the stock market makes no sense. You would assume that half of all stocks would outperform a market index while the other half would underperform. Then all you would have to do is pick from the top half and avoid the bottom half, make massive amounts of money and go buy an island somewhere.

Unfortunately, the stock market doesn’t follow a normal bell-shaped curve. Active investing may be a zero-sum game, but picking individual stocks is not. It doesn’t work out that half of all stocks outperform and half of all stocks underperform. There are huge tails when you look at the extreme over- and under-performers in the market.

Read more at http://awealthofcommonsense.com/2016/05/the-sp-500-is-the-worlds-largest-momentum-strategy/

Unfortunately, the stock market doesn’t follow a normal bell-shaped curve. Active investing may be a zero-sum game, but picking individual stocks is not. It doesn’t work out that half of all stocks outperform and half of all stocks underperform. There are huge tails when you look at the extreme over- and under-performers in the market.

Read more at http://awealthofcommonsense.com/2016/05/the-sp-500-is-the-worlds-largest-momentum-strategy/

In a GOLD rush, sell spades, shovels or donkeys but don't search for gold

| San Francisco in 1850 |

On May 12, 1848, a store owner named Sam Brannan held a “one-man parade” to announce the start of the San Francisco Gold Rush.

“Gold! Gold from the American River!” Brannan shouted up and down Market Street in San Francisco. He held his hat in one hand and waved a bottle of gold dust in the other. San Franciscans had received false news of gold before. But by all accounts, Brannan’s performance sent residents running in search of riches.

Brannan had a good reason for spreading the news rather than panning for gold himself. The canny entrepreneur owned a general store that served the workers at Sutter’s Mill, the site where gold was discovered. And in the week between learning about the discovery and yelling about it in San Francisco, he’d bought all the picks and shovels in the city.

Brannan’s announcement helped spur a seminal event in California’s history. As Brannan raked in money selling mining supplies, his actions also, years later, led to the coining of a famous maxim: During a gold rush, sell shovels.

It’s true that most miners fared poorly during the Gold Rush. But the men and women who prospered the most tended to ignore gold in favor of another resource: the hundreds of thousands of new arrivals who transformed an isolated frontier into a prosperous and industrialized population center in less than a decade.

“California needed everything and had nothing,” Edward Dolnick writes of the gold rush economy in his book The Rush. Businessmen and women who grasped this profited enormously from trade and the flow of goods and people to the new promised land.

Rather than advising someone to sell shovels and pick axes during a gold rush, better advice from the San Francisco Gold Rush might be to trade shovels. Or speculate in real estate. Or paint houses. Really anything other than mine for gold.

May 18, 2016

May 17, 2016

Elliott Wave Update of Nifty for 17 May 2016 Onward

Elliott Wave Update of Nifty for 17 May 2016 Onward

Deepak Kumar | May 17, 2016

This Elliott Wave Analysis report is further update on my previous analysis report Nifty can Bounce above 8032 without breaking below 7730 – EW Analysis on 15 May 2016 where I expected a bounce from 7783-7757 range for 8032 and Nifty already bounce 100 points from that range. I have updated the further possibilities and stoploss and outlook in this report. Please manage you trades accordingly as patterns are changing frequently and there will be no further updates on my blog for this week.

Nifty opened mild gap up at 7831 but declined sharply from 7845 to 7800 within 10 minutes after opening followed by consolidation between 7800-7772 range till 2 PM. Then Nifty bounced again by 100 points from low to register day’s high 7872 before closing 45 points up at 7860.

In Yesterday’s report, I suggested Buy on Dips for Nifty with stoploss of 7730 expecting positional targets above 8032, also suggested buy 7900 May cal on Dips. Nifty bounced from 7772 to 7872 and 7900 cal is almost double from today’s low. Now, let’s analyze fresh charts for further outlook of Nifty.

May 16, 2016

Neowave outlook on NIFTY by Vivek Patil

Structurally, remember, we considered the post-Budget development from 29th Feb’16 could be either a 7-legged “Diamond-Shaped” Diametric OR a 9-legged Symmetrical formation.

While Diametric Formation would require a “higher” top for the g-leg (as compared to the high of e-leg at 26101), Symmetrical formation would require a “lower” top to be made by the g-leg.

Market may be experiencing jitters on account of State election results coming in on 19th May’16 in the forthcoming week, and therefore, its trading in a volatile or indecisive until the results are actually known.

If the g-leg ends at a “lower” top compared to e-leg, then the rally post-Budget would be considered as 9-legged Symmetrical, similar to the pattern we saw 15th Jun’15 to 20th Aug’15 last year, which we labeled as 1st x-wave (or B of ET).

As we mentioned, Symmetrical formation could look like a “Rounding Top” similar to what happened in the 1st x-wave (or B or ET). Market’s response to the Election results coming on 19th May could help clarify the structure.

Read more at http://content.icicidirect.com/ULFiles/UploadFile_2016516104029.asp

While Diametric Formation would require a “higher” top for the g-leg (as compared to the high of e-leg at 26101), Symmetrical formation would require a “lower” top to be made by the g-leg.

Market may be experiencing jitters on account of State election results coming in on 19th May’16 in the forthcoming week, and therefore, its trading in a volatile or indecisive until the results are actually known.

If the g-leg ends at a “lower” top compared to e-leg, then the rally post-Budget would be considered as 9-legged Symmetrical, similar to the pattern we saw 15th Jun’15 to 20th Aug’15 last year, which we labeled as 1st x-wave (or B of ET).

As we mentioned, Symmetrical formation could look like a “Rounding Top” similar to what happened in the 1st x-wave (or B or ET). Market’s response to the Election results coming on 19th May could help clarify the structure.

Read more at http://content.icicidirect.com/ULFiles/UploadFile_2016516104029.asp

Mutual Funds: A Mockery of Disclosure

Maybe it had something to do with being ‘Friday the 13th’. Last Friday, for reasons that I cannot figure out, I was drawn into three separate, but equally vigorous conversations about how fund houses have chosen to interpret and act upon SEBI’s recent directive to disclose executive remuneration. Of the three people who reached out to me, one is a respected investment advisor, another is a former client who occasionally consults with me, and the third is a friend who happens to be a DIY investor.

All three of them were of the view that if a fund house had any reservations about making the said disclosure, it should have challenged SEBI. Since no fund house had done so, there was no reason for any fund house to not disclose the information as directed. Further, each of them felt that by adopting devious ways to mask the disclosure, most fund houses were making a mockery of it. To paraphrase my former client: “A law is followed either in letter, or in spirit, ideally in both. But in this instance, nearly the entire fund industry has chosen to ignore the spirit and to come up with their own perverse, pathetic and distorted interpretations of the letter.”

May 13, 2016

The collapse of Venezuela - one of the richest oil countries

This is an excellent article for student's of economy, public policy, finances and the layman on how wrong decisions (socialism?) can mess up an excellent economy.

Venezuela, in spite of having some of the best oil reserves in the world, is facing severe problems - problems which started well before the collapse of the oil trade.

Extreme poverty, hyper inflation, shortage of basic essentials, collapse of basic govt services and so on.

Can this happen in India? Read this article and find out.

Link to article: http://www.theatlantic.com/international/archive/2016/05/venezuela-is-falling-apart/481755/

Venezuela, in spite of having some of the best oil reserves in the world, is facing severe problems - problems which started well before the collapse of the oil trade.

Extreme poverty, hyper inflation, shortage of basic essentials, collapse of basic govt services and so on.

Can this happen in India? Read this article and find out.

Link to article: http://www.theatlantic.com/international/archive/2016/05/venezuela-is-falling-apart/481755/

The Stock Market is the Biggest Casino

At some point Parvizi cottoned to the idea that he didn’t have to wait for shares to move to make money: He could make it happen himself. He got to know reporters at the Financial Times and the Daily Mail and began speaking to them frequently. If they brought up a topic, he knew there was a chance it would appear in the next day’s paper and the shares would pop, he said. By then, he was also a big enough investor that buying shares and letting the market know about it could be enough to ramp up the price.

On his third day on the stand, Parvizi was cross-examined by Financial Conduct Authority barrister Mark Ellison. The lawyer asked him how he had made money by spreading rumors. The trader gave the example of an occasion when he phoned a journalist he knew and tried to “plant the seed” that a takeover bid for Sky, then known as BSkyB, was in the offing. The idea was that the reporter would notice higher than average trading and assume something was going on, he said.

At the prosecutor’s prompting, the judge turned to Parvizi and warned him he was at risk of admitting the separate criminal offense of attempting to manipulate markets by making deliberately misleading statements.

The stock market was “the biggest casino in the world,” Parvizi said. The only offense as far as he was concerned was trading on nonpublic information, which he denied ever doing.

You had no idea about rules on dealing? Ellison asked.

“You’re making out like I’m the only liar in the stock market,” Parvizi said, looking around the room for support. “If everyone told the truth, the stock market would not move.”

On his third day on the stand, Parvizi was cross-examined by Financial Conduct Authority barrister Mark Ellison. The lawyer asked him how he had made money by spreading rumors. The trader gave the example of an occasion when he phoned a journalist he knew and tried to “plant the seed” that a takeover bid for Sky, then known as BSkyB, was in the offing. The idea was that the reporter would notice higher than average trading and assume something was going on, he said.

At the prosecutor’s prompting, the judge turned to Parvizi and warned him he was at risk of admitting the separate criminal offense of attempting to manipulate markets by making deliberately misleading statements.

The stock market was “the biggest casino in the world,” Parvizi said. The only offense as far as he was concerned was trading on nonpublic information, which he denied ever doing.

You had no idea about rules on dealing? Ellison asked.

“You’re making out like I’m the only liar in the stock market,” Parvizi said, looking around the room for support. “If everyone told the truth, the stock market would not move.”

May 12, 2016

Do SIP in NFBEES and sell when NIFTY hits 30K

Good title to grab anyone's attention.

I am a big fan of NIFTYBEES and for small investors this is an excellent product. Just invest a fixed sum every month for 4-5 years and let the market do the rest.

I avoid actively managed funds solely because of high mgmt fees and the global statistical evidence about fund performance.

The only exception I make here is for tax saving schemes.

I am a big fan of NIFTYBEES and for small investors this is an excellent product. Just invest a fixed sum every month for 4-5 years and let the market do the rest.

I avoid actively managed funds solely because of high mgmt fees and the global statistical evidence about fund performance.

The only exception I make here is for tax saving schemes.

End son-in-law treatment for FIIs; India no Africa: Jhunjhunwala

Terming the amendment to the India-Mauritius Double Tax Avoidance Agreement (DTAA) as a "sensible move by a sensible government", ace investor Rakesh Jhunjhunwala said income on investments made by foreign investors should be subject to tax.

"The move is well thought out. It will put all litigation to rest. It is coming into effect in March 2017 anyway," he told CNBC-TV18 in an exclusive interview. Jhunjhunwala's comments came in the wake of the government's decision to amend the Mauritius treaty, which will allow it to levy capital gains tax on FII income.

He also allayed fears that the law would hamper inflows coming in through the participatory notes route, saying that as long as FIIs were able to get decent returns from India, they would not mind paying tax. "I have not seen a bull market in which people don't participate because there is a 20% rate of tax. If people see signs of income, money will come," he said.

Read more at: http://www.moneycontrol.com/news/market-outlook/end-son-in-law-treatment-for-fiis-india-no-africa-jhunjhunwala_6615161.html

"The move is well thought out. It will put all litigation to rest. It is coming into effect in March 2017 anyway," he told CNBC-TV18 in an exclusive interview. Jhunjhunwala's comments came in the wake of the government's decision to amend the Mauritius treaty, which will allow it to levy capital gains tax on FII income.

He also allayed fears that the law would hamper inflows coming in through the participatory notes route, saying that as long as FIIs were able to get decent returns from India, they would not mind paying tax. "I have not seen a bull market in which people don't participate because there is a 20% rate of tax. If people see signs of income, money will come," he said.

Read more at: http://www.moneycontrol.com/news/market-outlook/end-son-in-law-treatment-for-fiis-india-no-africa-jhunjhunwala_6615161.html

Catch -22 of Value Driven Investing

Value has always been a risky strategy, particularly for those trying to run an investment business.

The drivers of mean reversion are not hugely powerful at any given time, meaning asset prices and even the underlying fundamentals can move in unexpected ways for disappointingly long periods. It is a little glib to say that without this risk, it would be difficult for asset prices to get meaningfully out of line in the first place, but the reality is that the only way you can get really exciting opportunities for mean reversion is to have misvalued assets become even more misvalued before they revert to fair value.

This is the catch-22 of value-driven investing. Your best opportunities will almost always come just at the time your clients are least interested in hearing from you, and might possibly come at the times when you are most likely to be doubting yourself.-wrote Jeremy Grantham

May 11, 2016

Craters – Not Cracks – Are Finally Emerging at ICICI Bank

|

| ICICI BANK monthly charts |

ICICI Bank, India’s largest private sector bank by assets, posted shocking results for the quarter ended March 31, 2016. The consensus analyst forecast for the bank’s net profit was Rs. 3,100 crores; the bank reported a paltry Rs. 702 crores. This was an annual decline of 76% (compared to Rs. 2,922 crores in 4QFY2015) and a quarterly decline of 77% (Rs3,018 crores in 3QFY2016).

In fact, the results were far worse than the reported numbers suggest.

Overall profits were inflated by including exceptional items – Rs. 2,131 crores of profits on sale of part of ICICI Bank’s shareholding in ICICI Prudential Life Insurance and ICICI Lombard General Insurance, and a deferred tax asset of Rs. 2,200 crores. These items in effect considerably negated the impact of the special provision of Rs. 3,600 crores. Excluding these two items, ICICI Bank has posted a huge loss for the quarter. The stock market penalised the bank, and the stock closed at Rs. 215 on May 5, a decline from Rs. 240 on April 28. With that, ICICI Bank lost its position as the second largest private sector bank by market capitalisation to Kotak Mahindra Bank.

ICICI Bank also finally reported that it had Rs. 44,000 crores “below investment grade” in power, iron and steel, mining, cement and rigs sectors. This was in addition to its net non-performing loans of Rs. 12,963 crores and net restructured standard loans of Rs. 8,573 crores. The bank expects its future non-performing loans to emerge from the category of below investment grade.

Read more at http://thewire.in/2016/05/09/craters-not-cracks-are-finally-emerging-at-icici-bank-34601

Insurance scams - loans at 5% - a must read

So, the other day, I received a routine junk call from a Delhi-based number. But the man at the other end of the line didn’t start with the usual “Sir, are you looking for a loan?” spiel.

Instead, he asked: “Sir, I can offer you a loan at 4.99%. Interested?” He got my attention.

How could he possibly offer me a loan at 4.99% I wondered? “If I take a loan from you at that rate and deposit it in my Savings Bank account, I’ll get double the interest rate. What’s the catch?” I asked of him.

“Nothing,” he said. “I am from the Future Group founded by Kishore Biyani. It’s a two day offer and we’re doing it to attract new clients to whom we can cross sell other products later from our portfolio,” he said, sounding rather earnest.

Having spent two decades in business journalism, I know if something sounds too good to be true, it can’t be true. I ended up engaging with him in an hour-long conversation.

Read complete article at http://www.foundingfuel.com/article/a-day-in-the-life-of-india

Instead, he asked: “Sir, I can offer you a loan at 4.99%. Interested?” He got my attention.

How could he possibly offer me a loan at 4.99% I wondered? “If I take a loan from you at that rate and deposit it in my Savings Bank account, I’ll get double the interest rate. What’s the catch?” I asked of him.

“Nothing,” he said. “I am from the Future Group founded by Kishore Biyani. It’s a two day offer and we’re doing it to attract new clients to whom we can cross sell other products later from our portfolio,” he said, sounding rather earnest.

Having spent two decades in business journalism, I know if something sounds too good to be true, it can’t be true. I ended up engaging with him in an hour-long conversation.

Read complete article at http://www.foundingfuel.com/article/a-day-in-the-life-of-india

May 10, 2016

Neowave analysis for week starting 9th MAY

In the coming week, due to its oversold nature, we may watch if another contrary trade is possible, but on the +ve side.

If the post-Budget rally is indeed a “Diamond-Shaped” Diametric, then the upward g-leg can completely retrace the f-leg of fall, and achieve new heights for the rally.

However, since f-leg turned arithmetically “bigger” than the d-leg, it is possible that the post-Budget rally may be turning into a 9-legged Symmetrical Formation, similar to what we saw inside the 1st x-wave (or “B” wave of our alternate Expanding Triangle possibility).

As one can seen after higher highs till e-leg, the Symmetrical formation inside 1st x-wave showed lower highs for g & i legs.

Symmetrical formation, as a result, can look like a “Rounding Top” similar to what we saw during Jul-Aug’15 last year. The last leg of this pattern would be i-leg, and the faster retracement of the last leg would confirm completion of the pattern.

If it indeed turns out to be a Symmetrical Formation, (instead of “Diamond-Shaped” Diametric), then 3 more legs, g-h-i, are pending. Thus, Symmetrical formation could stretch the end-point of the rally further.

Remember, the Symmetrical formation we saw earlier was from 15th Jun’15 to 20th Aug’15, i.e. it formed over 48 trading sessions. Against this, the current post-Budget rally has consumed 43 days.

By our alternate Expanding Triangle (ET) assumption for the rally, the post-Budget rally is considered as “D” of ET. The “D” leg is already “bigger” than “B” leg price-wise. Ideally, it should be “bigger” time-wise as well.

Therefore, if it indeed turns out to be a Symmetrical formation, then we cannot rule out the rally would end only after 13thMay’16, after achieving “larger” time as compared to the “B” leg.

In case Index fails to open the much-expected g-leg in the fresh week, then we may assume f-leg is still developing. Remember, in Jul’15 last year, the f-leg had completely retraced the e-leg.

Read more at http://content.icicidirect.com/ULFiles/UploadFile_201659105159.asp

If the post-Budget rally is indeed a “Diamond-Shaped” Diametric, then the upward g-leg can completely retrace the f-leg of fall, and achieve new heights for the rally.

However, since f-leg turned arithmetically “bigger” than the d-leg, it is possible that the post-Budget rally may be turning into a 9-legged Symmetrical Formation, similar to what we saw inside the 1st x-wave (or “B” wave of our alternate Expanding Triangle possibility).

As one can seen after higher highs till e-leg, the Symmetrical formation inside 1st x-wave showed lower highs for g & i legs.

Symmetrical formation, as a result, can look like a “Rounding Top” similar to what we saw during Jul-Aug’15 last year. The last leg of this pattern would be i-leg, and the faster retracement of the last leg would confirm completion of the pattern.

If it indeed turns out to be a Symmetrical Formation, (instead of “Diamond-Shaped” Diametric), then 3 more legs, g-h-i, are pending. Thus, Symmetrical formation could stretch the end-point of the rally further.

Remember, the Symmetrical formation we saw earlier was from 15th Jun’15 to 20th Aug’15, i.e. it formed over 48 trading sessions. Against this, the current post-Budget rally has consumed 43 days.

By our alternate Expanding Triangle (ET) assumption for the rally, the post-Budget rally is considered as “D” of ET. The “D” leg is already “bigger” than “B” leg price-wise. Ideally, it should be “bigger” time-wise as well.

Therefore, if it indeed turns out to be a Symmetrical formation, then we cannot rule out the rally would end only after 13thMay’16, after achieving “larger” time as compared to the “B” leg.

In case Index fails to open the much-expected g-leg in the fresh week, then we may assume f-leg is still developing. Remember, in Jul’15 last year, the f-leg had completely retraced the e-leg.

Read more at http://content.icicidirect.com/ULFiles/UploadFile_201659105159.asp

Is Warren Buffett really a big fan of the S&P 500?

Buffett is a big fan of the S&P 500. He has already declared that 90 percent of the money he leaves to his wife will be invested in Vanguard’s S&P 500 index fund. He also wagered a million dollars that Vanguard’s S&P 500 index fund would beat a basket of hedge funds over ten years from 2008 to 2017. (The S&P 500 index fund is currently crushing the hedgies.)

Buffett’s enthusiasm for the S&P 500 is a wee bit odd because he has spent an entire career guided by the investment principles of his teacher, Ben Graham, who can genuinely be called the godfather of active investing. Graham’s investment approach, in a nutshell, is to buy quality companies at a cheap price. That’s the furthest thing from just throwing your money into an S&P 500 index fund.

At the same time, Berkshire’s portfolio is also higher quality than the S&P 500. The companies in Berkshire’s portfolio have an average return on equity of 13.1 percent versus 12 percent for the S&P 500, and Berkshire’s companies’ earnings are less volatile than the earnings of the S&P 500.

Read more at http://www.bloomberg.com/gadfly/articles/2016-05-05/inside-warren-buffett-s-love-affair-with-the-s-p-500

Buffett’s enthusiasm for the S&P 500 is a wee bit odd because he has spent an entire career guided by the investment principles of his teacher, Ben Graham, who can genuinely be called the godfather of active investing. Graham’s investment approach, in a nutshell, is to buy quality companies at a cheap price. That’s the furthest thing from just throwing your money into an S&P 500 index fund.

At the same time, Berkshire’s portfolio is also higher quality than the S&P 500. The companies in Berkshire’s portfolio have an average return on equity of 13.1 percent versus 12 percent for the S&P 500, and Berkshire’s companies’ earnings are less volatile than the earnings of the S&P 500.

Read more at http://www.bloomberg.com/gadfly/articles/2016-05-05/inside-warren-buffett-s-love-affair-with-the-s-p-500

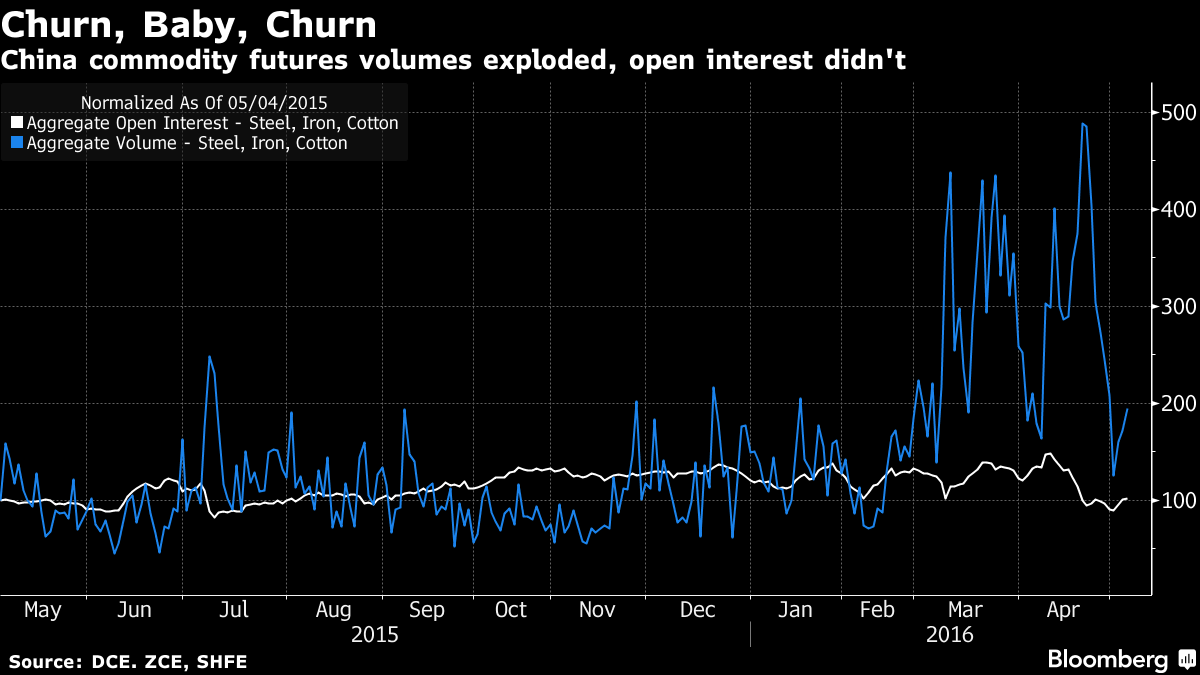

The World's Most Extreme Speculative Mania Unravels in China

From the Dutch tulip craze of 1637 to America’s dot-com bubble at the turn of the century, history is littered with speculative frenzies that ended badly for investors.

But rarely has a mania escalated so rapidly, and spurred such fevered trading, as the great China commodities boom of 2016. Over the span of just two wild months, daily turnover on the nation’s futures markets has jumped by the equivalent of $183 billion, outpacing the headiest days of last year’s Chinese stock bubble and making volumes on the Nasdaq exchange in 2000 look tame.

Read more at http://www.bloomberg.com/news/articles/2016-05-09/world-s-most-extreme-speculative-mania-is-unraveling-in-china

Thyrocare gains 40% on listing

Thyrocare is the fourth health-care firm in the past six months to see its shares rise more than 30 per cent on listing day. Shares of Dr Lal PathLabs, Alkem Laboratories, and Narayana Hrudayalaya had gained 49.8, 31.6 per cent, and 34.7 per cent, respectively, on listing day. The only health-care firm which had made a dismal debut in the past six months is HealthCare Global Enterprises, whose shares fell 21 per cent on listing day.

Preventive health-care firm Thyrocare's Initial Public Offering (IPO) of shares had generated huge demand last week, with the issue subscribed over 52 times. The Qualified Institutional Buyers (QIB) portion was subscribed 76 times; the non-institutional bidders, or high networth individual (HNI, or the super-rich) portion was subscribed 225 times and the retail (small) quota was subscribed 8.4 times.

Read more at http://www.business-standard.com/article/markets/in-debut-thyrocare-healthier-than-others-116050900780_1.html

Subscribe to:

Posts (Atom)