April 30, 2016

Baba Ramdev idea under serious consideration in America

Baba Ramdev made big news with one idea when Anna agitation was at peak:

The idea: Withdraw all big currency notes because lots of business transactions are done in cash to evade taxes. But his idea was rejected because it came from a Baba.

You can read the entire article here

The argument is simple: High denomination note is a boon to corruption and crime. Lawrence Summers solution: "a global agreement to stop issuing notes worth more than say $50 or $100". This is being hailed by many as next big disruptive idea which will destroy the business models of tax evaders, criminals and terrorists. It will also end high-value bribes.

The idea: Withdraw all big currency notes because lots of business transactions are done in cash to evade taxes. But his idea was rejected because it came from a Baba.

You can read the entire article here

The argument is simple: High denomination note is a boon to corruption and crime. Lawrence Summers solution: "a global agreement to stop issuing notes worth more than say $50 or $100". This is being hailed by many as next big disruptive idea which will destroy the business models of tax evaders, criminals and terrorists. It will also end high-value bribes.

Interestingly Baba Ramdev made the same argument 2-3 yrs back. Now, I am sure even people in India will debate this because it comes from Harvard professor and former Treasury Secretary. People in India run down our own people because we consider people who cannot speak good English as low IQ people. Common sense has nothing to do with language. But unfortunately, our colonial minds will never come out of this closed mindset.

Read more/ source: State of the Market - is this the reason why Gold is rallying?

Read more/ source: State of the Market - is this the reason why Gold is rallying?

ICICIBANK net profit down 76%

|

| Stock has support at 150 and resistance 280... weekly charts |

High-speed trading backlash mounts pressure on Sebi

The Securities and Exchange Board of India (Sebi) is coming under increased pressure to improve its oversight of high-speed trading after allegations of unfair access at the nation's biggest equity bourse.

The country's top brokerage associations are among a growing chorus of voices calling for Sebi to take action after an investigation by one of its own advisory panels claimed that there may have been collusion between the National Stock Exchange of India and a high-frequency trading (HFT) firm. The panel is pushing for Sebi to frame more detailed rules on HFT and punish anyone found of wrongdoing, according to a person with direct knowledge of the matter.

Sebi's public silence on the internal report's findings - which were reported by Bloomberg and local media this month - has added to a sense of frustration among many local brokers and investors who say that insufficient regulations on high-frequency trading have made India's markets vulnerable to abuse. While Sebi has issued broad guidelines dating as far back as 2012, critics argue they don't do enough to address how traders should connect to exchanges and how orders should be processed.

Read more at http://www.business-standard.com/article/markets/high-speed-trading-backlash-mounts-pressure-on-sebi-116042901560_1.html

The country's top brokerage associations are among a growing chorus of voices calling for Sebi to take action after an investigation by one of its own advisory panels claimed that there may have been collusion between the National Stock Exchange of India and a high-frequency trading (HFT) firm. The panel is pushing for Sebi to frame more detailed rules on HFT and punish anyone found of wrongdoing, according to a person with direct knowledge of the matter.

Sebi's public silence on the internal report's findings - which were reported by Bloomberg and local media this month - has added to a sense of frustration among many local brokers and investors who say that insufficient regulations on high-frequency trading have made India's markets vulnerable to abuse. While Sebi has issued broad guidelines dating as far back as 2012, critics argue they don't do enough to address how traders should connect to exchanges and how orders should be processed.

Read more at http://www.business-standard.com/article/markets/high-speed-trading-backlash-mounts-pressure-on-sebi-116042901560_1.html

Ninety-nine percent of Buffett's wealth was earned after his 50th birthday.

When Buffett was 52, his net worth was about $376 million.

Plus, he made about 94% of his wealth after turning 60.

At 59, he was worth "only" $3.8 billion.

Talk about long-term investment strategies.

Source: Value Walk

My take: this is nothing but power of compounding... the earlier you start, the more you benefit.

April 29, 2016

Nestlé’s Half-Billion-Dollar Noodle Debacle in India

An excellent real life case study on crisis management for management students and people...

Full article at http://fortune.com/nestle-maggi-noodle-crisis

Summary....

Full article at http://fortune.com/nestle-maggi-noodle-crisis

Summary....

April 28, 2016

Rana Kapoor: How Yes Bank emerged from NPA crisis unscathed

Q: What is your secret? If you are 65 percent exposed to a corporate sector which for everybody else is throwing up probably 15 percent of bad loans, how is it that your 65 percent is producing less than 1 percent of bad loans?

A: The solution lies in building a risk culture, building a risk architecture and building 3 eyed principle which at least in our bank is defined as relationship managers, product managers and risk managers who all look at a relationship from all angles. That makes sure that when you have a problem the red flag surfaces early enough.

Second principle is that risk is related to structure. This is not a commoditised business. This business is about specialisation. So, depending on the segment, depending on the industry sector banks need to specialise.

I am very pleased to share with you that after 12 years Yes Bank has proven over the last 32 quarters, since the global crisis started, that we are committed to building the risk architecture through specialisation. Everybody is affected by the heightened risk environment but more importantly is how do you salvage that, how do you proactively de-risk. Not everybody is a wilful defaulter. There are some very genuine problems and you have to help them through preservation of economic value, preservation of assets. 90-95 percent are good businesses.

Read more at: http://www.moneycontrol.com/news/results-boardroom/rana-kapoor-how-yes-bank-emergednpa-crisis-unscathed_6429341.html

|

| Yesbank at lifetime highs |

A: The solution lies in building a risk culture, building a risk architecture and building 3 eyed principle which at least in our bank is defined as relationship managers, product managers and risk managers who all look at a relationship from all angles. That makes sure that when you have a problem the red flag surfaces early enough.

Second principle is that risk is related to structure. This is not a commoditised business. This business is about specialisation. So, depending on the segment, depending on the industry sector banks need to specialise.

I am very pleased to share with you that after 12 years Yes Bank has proven over the last 32 quarters, since the global crisis started, that we are committed to building the risk architecture through specialisation. Everybody is affected by the heightened risk environment but more importantly is how do you salvage that, how do you proactively de-risk. Not everybody is a wilful defaulter. There are some very genuine problems and you have to help them through preservation of economic value, preservation of assets. 90-95 percent are good businesses.

Read more at: http://www.moneycontrol.com/news/results-boardroom/rana-kapoor-how-yes-bank-emergednpa-crisis-unscathed_6429341.html

April 27, 2016

The Rise of the Most Powerful Idea in Investing

The biggest story in the finance industry during the past decade might not be the 2008 crisis, or new regulation, or even record-low interest rates. Maybe it's the shift from active to passive-investment management. In the realm of mutual funds, the change is stunning.

Why is this happening? One reason is technology, which makes it much easier to trade large numbers of different assets at the same time, and to construct baskets of assets that track indexes closely. Another factor might be low interest rates and declining returns, which make asset-management fees more salient and painful, pushing people toward low-fee passive-investment vehicles.

Financial markets do a decent, if not always perfect, job of scooping up available information about the value of stocks and other assets, and incorporating this information into the price. People who try to beat the market are likely to lose, since they tend to be trading on stale information, while paying fees at the same time.

Instead, why not just sit back, skip most of the fees and earn the market average return, sometimes known as beta? You’ll be doing better than more than half the money out there in the market, and saving effort besides.

Read more at http://www.bloombergview.com/articles/2016-04-21/the-rise-of-the-most-powerful-idea-in-investing

Why is this happening? One reason is technology, which makes it much easier to trade large numbers of different assets at the same time, and to construct baskets of assets that track indexes closely. Another factor might be low interest rates and declining returns, which make asset-management fees more salient and painful, pushing people toward low-fee passive-investment vehicles.

Financial markets do a decent, if not always perfect, job of scooping up available information about the value of stocks and other assets, and incorporating this information into the price. People who try to beat the market are likely to lose, since they tend to be trading on stale information, while paying fees at the same time.

Instead, why not just sit back, skip most of the fees and earn the market average return, sometimes known as beta? You’ll be doing better than more than half the money out there in the market, and saving effort besides.

Read more at http://www.bloombergview.com/articles/2016-04-21/the-rise-of-the-most-powerful-idea-in-investing

My note: In India, you can easily do by simply investing a fixed sum in NIFTY BEES every month. I wrote a post on this 3-4 years ago.

Top 10 defaulting companies

A Reserve Bank list, obtained exclusively by a team of journalists at Newslaundry.com, chronicles India's largest loan defaulters.

Read more at: http://www.moneycontrol.com/news/business/revealed-these-arecountry39s-top-10-defaulting-companies_6414181.html

Read more at: http://www.moneycontrol.com/news/business/revealed-these-arecountry39s-top-10-defaulting-companies_6414181.html

Question on covered call writing

Anant Pal Singh

Sir, i want to do covered call. For this i am planning to buy shares in equity ( equal to F&O lot size ) and sell ATM call at the start of every month. Can you suggest some good shares for this strategy. How much return it can give monthly? Is it a good strategy ?

Answer

Covered call writing is a good strategy to earn a steady income from the stock market. Here you are writing an ATM call while simultaneously taking a long position in the underlying stock.

The profit on the short call is guaranteed irrespective of whether the stock goes up, down or is rangebound.

Sir, i want to do covered call. For this i am planning to buy shares in equity ( equal to F&O lot size ) and sell ATM call at the start of every month. Can you suggest some good shares for this strategy. How much return it can give monthly? Is it a good strategy ?

Answer

Covered call writing is a good strategy to earn a steady income from the stock market. Here you are writing an ATM call while simultaneously taking a long position in the underlying stock.

The profit on the short call is guaranteed irrespective of whether the stock goes up, down or is rangebound.

What is the risk?

April 26, 2016

April 25, 2016

April 22, 2016

April 21, 2016

Buy and sell signals

LAST updated: 21-APR-2016 :: 17:13:37

- Computer generated BUY and SELL signals.

- Signals are for your study only and are completely unsuitable for trading.

- Golden stoploss: min 10% or last month's low (long position).

- Do not risk more than 1% of your capital on any trade.

- All charts are provided by icharts.in

ALLAHABAD BANK BUY signal

A Dose of Rakesh Jhunjhunwala

These RJ’s views & responses to questions posed should interest you :

On The Future of Equity Markets ~ Reiterates this is only the Trailer & we are going to witness a Mother of all Bull Runs.India is a thriving young Democracy with US $ 600 b in Savings every year.Equity Markets receive just US $ 50 b from this.This has to improve and it will ~ anyone ,any doubt!?

On Returns from Equity ~ Ironically while his riches have been through multibagger 1000% + equity gains in concentrated high weightage stocks like Titan & Crisil he asserts that one should be happy with 18% CAGR gains and if it goes to 24% one should be really happy

On Concentration of his Wealth ~ all his wealth ,he’s a Billionaire in US $, comes from the Value of his Direct Equity Investments & he’s been lucky with them~ Titan has a huge weightage ~ he revealed he hardly has Rs 50000 in Fixed Deposits and some in PPF & of course some in Real Estate

On favourite Sector & Stock ~ Real Estate & DLF ~ sector will recover strong in the coming 4 years & DLF has a market cap of under Rs 5000 crs~ Residential Property he picked up at 2000/sq ft in Mumbai is now Rs 50000/sq ft & if GDP is growing and India is evolving as a democracy then it’s a matter of time again for real estate to grow again

Other Sectors he favours ~ IT & Pharma ~ IT is a great Value add with US $ 80 b from the US $ 120 b exports coming into the country while Oil & Gas Exports of US $ 100 b contributes just US $ 10 b of value add

A huge case for Defense Sector ~ is betting that in the next 10 years India will become a net exporter of Arms

April 20, 2016

Open interest changes AFL

Many traders study changes in open interest with change in price and then try and anticipate what will happen next.

This AFL lists the % change of the underlying and also the change in the open interest. You can then sort the respective columns and develop your trading strategy.

More info on open interest is available at http://www.vfmdirect.com/info/open.html

And this is the AFL

>>>

<<<

This AFL lists the % change of the underlying and also the change in the open interest. You can then sort the respective columns and develop your trading strategy.

More info on open interest is available at http://www.vfmdirect.com/info/open.html

And this is the AFL

>>>

Filter=1;

AddColumn(C,"Close",1.2);

AddColumn(ROC(C,1),"% change",1.2);

AddColumn(ROC(OpenInt,1),"% OI change",1.2);

<<<

April 19, 2016

April 17, 2016

5 similarities between poker and stock market investing

1- Variance is at poker what volatility is at stock market

Whoever has played poker before knows that luck is part of the game and that in the short term, bad luck can be pretty brutal sometimes too. In poker, we call that variance. Variance is a measurement of the spread between numbers in a data set. It aims to measure how far each number in the set is from the mean or expectation. In short, higher is the variance, the more the actual results can be far from the expectation; lower is the variance, closer they will be to the mean or expectation. In poker, when you take a good decision, sometimes bad luck still makes you lose the hand. The actual result is then inferior to the expected result. However, if you repeat this good decision hundreds or even thousands of times, in the end luck will almost completely be out of the equation.

In stock market, we will rather talk about volatility. In finance, volatility represents the extent of changes in the price of a financial asset. Like in poker, it’s possible to make a good investment decision but something out of left field happens and changes your initial investment thesis and you end up with a loss instead of a profit. In both cases, you need to focus on the fact that in the long term, a series of good decisions will always make you a winner in the end, whatever the short term results might be.

2- Emotions control is primordial and sometimes underestimated

When a poker player goes through a stretch of bad lucks, he can be prone to enter a mental state that we call tilt, which is basically poor decision-making due to a loss of control over his emotions. At that time, the player begins to think in an irrational way and to act impulsively. It’s a very dangerous phase in which any serious poker player must be able to notice what is happening and step away from the table if he thinks he’s not able to make good decisions anymore.

In the stock market, the daily fluctuations of stock prices are mostly based on investors’ emotions, who trade according to their spur of the moment. Technical analysis was built around that idea. The chart of a stock is actually a graphical representation of investors’ emotions throughout a period of time. Investors’ emotions can bring the price of stock to a point where it’s significantly different from its intrinsic value – for novices, intrinsic value is a theoretical concept and refers to the value obtained after a rational or fundamental analysis of the risks and future perspectives of a financial asset -. When an investor does the fundamental analysis of a company and takes the decision to buy it, he must be aware of his emotions and not let them influence him when the price of the stock fluctuates. It’s when they listen to their emotions that a lot of novice investors (I’ve done it too) end up buying a stock at its peak after a long run up, just to see it crash in spectacular fashion a few days or weeks after, or sell a stock at a loss to see it make a miraculous come-back right after. I sincerely believe that emotional control and discipline are among the most important elements to improve, for the poker player as well as for the stock market investor, and it is too often ignored.

Big move coming in S&P500

A big move is coming in the S&P 500 and it will take everyone’s breath away. Simply put: The S&P 500 has traded in a multi-year consolidation range with a high of 2134 and a low of 1810. A breakout or breakdown out of this range could result in a measured technical move of the height of the range, i.e. 2134 – 1810 = 324 handles. Consequently a break toward the upside would target 2458 (15% above all time highs) and conversely a breakdown would target 1486 and represent a 30.4% correction off of all time highs.

Read more at http://www.zerohedge.com/news/2016-04-16/big-move-coming

Read more at http://www.zerohedge.com/news/2016-04-16/big-move-coming

April 14, 2016

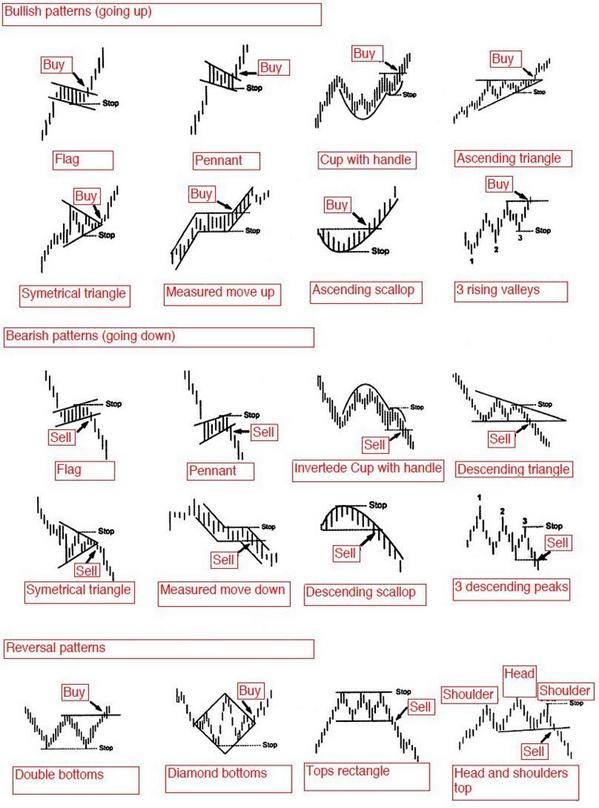

Demand and supply move prices

Demand and supply move prices... nothing else.

And levels of where buying or selling are likely to appear are visible on charts.

Once you understand this, then there is no need to for any indicator or further analysis.

Just remember that prices go up because there are more buyers (demand) than sellers (supply). This is all what you need to know.

The chart tells everything you need to know...

And levels of where buying or selling are likely to appear are visible on charts.

Once you understand this, then there is no need to for any indicator or further analysis.

Just remember that prices go up because there are more buyers (demand) than sellers (supply). This is all what you need to know.

The chart tells everything you need to know...

Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into nothing more than a TV studio for financial cable networks.

No, the real answer of what the most important building if for US capital markets, and not just stocks, but all assets classes, as under its roof on a daily basis electronic trades representing many trillions of dollars’ worth of equities, derivatives, currencies, and fixed-income take place, is the Equinix NY4 data center, located at 755 Secaucus Road, in Secaucus, NJ 07094.

This, as Bloomberg puts it in its fascinating profile of this particular structure, "is where Wall Street actually transacts."

Behold what the new trading floor looks like: This view from a catwalk shows some of the miles of fiber-optic cable that connect to machines below.

Photo: Bloomberg

The first thing that any entrant in this giant, semi-refrigerated warehouse containing millions of servers will notice is that there are virtually no humans to be seen anywhere. Yes: the Equinix's NY4 data center hosts 49 exchanges (among the customers that pay to use this Secaucus location) and it is all just servers and fiberoptic interconnections either between them, or to the outside world.

April 13, 2016

Subscribe to:

Posts (Atom)