May 30, 2014

Market outlook

NIFTY takes support at 7100 and forms a bullish candle. Now the region between 7000 and 7100 is a gap so this entire region will act as support.

In addition, markets are expected to take fancy to 7000... big round number... numbers like this 6000,7000, 20000 act as psychological support/ resistance levels.

Option writing points to support at 7000-6800 and resistance at 7500 ... this means rangebound markets this month.

In addition, markets are expected to take fancy to 7000... big round number... numbers like this 6000,7000, 20000 act as psychological support/ resistance levels.

Option writing points to support at 7000-6800 and resistance at 7500 ... this means rangebound markets this month.

Question: how to get buy/ sell signals in Amibroker

I use Ami. Suppose I install mechanical trading system or good indicator ( like Supertrend ) based trading system in Ami to trade these stock, can I get notification of buy/ sell signal of these stocks in separate window in Ami. To see buy/sell signals in Ami. we have to select stock from drop-down list to see the signals.It will be very difficult to check the signals every time from the large list of stocks if we use hourly or two hourly TF.

Is there any AFL for getting notification of the signals in separate window.

Dr.Suhas Kothavale.

Is there any AFL for getting notification of the signals in separate window.

Dr.Suhas Kothavale.

May 29, 2014

Market outlook

Markets break the lower trendline and force me to discard my "triangle" view.

The reason is for a valid triangle, one must have at least 5 equi-spaced contact points - 2 on one trendline and 3 on the other one. That is not the case this time. At best we can just assume there is a break of the lower trendline.

The reason is for a valid triangle, one must have at least 5 equi-spaced contact points - 2 on one trendline and 3 on the other one. That is not the case this time. At best we can just assume there is a break of the lower trendline.

Intraday analysis

Break of initial trading range low at 7320 F was first sell signal (first line).

Thereafter markets traded in a range and formed a resistance at 7305 F (second line).

Thereafter markets traded in a range and formed a resistance at 7305 F (second line).

May 28, 2014

Market outlook

Expecting nifty to trade in a triangle.... as we are towards lower end, expect a move to the upper end without crossing the upper sloping trendline.

Breakout from triangle will provide clarity of direction and thus an indication of possible trade.

Breakout from triangle will provide clarity of direction and thus an indication of possible trade.

May 27, 2014

Market outlook

Expecting formation of a triangle... current structure implies one small up leg pending followed by another leg down.

Breakout from triangle will provide clarity of direction and thus an indication of possible trade.

Breakout from triangle will provide clarity of direction and thus an indication of possible trade.

Rakesh Jhunjhunwala says this is the mother of all bull markets

We are at the cusp of an era of strong policy framework, business and investor friendly environment, elimination of supply-side constraints, initiation of a new capex cycle, falling interest rates, resumption of job creation, rising savings and a wall of foreign inflows combined with domestic outflows reversing into domestic inflows with a vengeance.

We are at the cusp of an era of strong policy framework, business and investor friendly environment, elimination of supply-side constraints, initiation of a new capex cycle, falling interest rates, resumption of job creation, rising savings and a wall of foreign inflows combined with domestic outflows reversing into domestic inflows with a vengeance.While this is more obvious now, most of us are unable to comprehend the scale and the longevity of this change. We are at a stage where we are blin ..

Read more at:

http://economictimes.indiatimes.com/articleshow/35625446.cms

May 26, 2014

Market outlook

Today we had formation of a large outside day bar... this is an indication of a possible trend reversal.

This has also happened near a known resistance area.

This has also happened near a known resistance area.

Intraday analysis

Crossover above initial high at 7465F was bullish and a buy signal. This got stopped out on break of 7485F.

Breakout of day's low at 7440F was a sell signal...

Breakout of day's low at 7440F was a sell signal...

Warning signs

Today, a leading mutual fund placed a full cover page (incl. reverse) advertisement in a leading newspaper. The ad says "wake up.... to your tarakki" and extols the virtues of investing in equity mutual funds etc.

Elliot wave outlook of market

According to neowave analysts, the wave from SEP 2013 lows is nearing its end. This wave is called the F wave and after its completion the G wave is expected to open downwards and is likely to last a year or so.

May 25, 2014

How to buy stocks like HCL-INSYS or CANARA BANK after they are already up 10-15%?

HCL-INSYS was up 16% Friday and 42% in 3 days.

CANBK was up 13% on Friday and gained 64% this month.

How do you trade these stocks?

CANBK was up 13% on Friday and gained 64% this month.

How do you trade these stocks?

Question: how can a Investor book max profit

I strongly believe there should be some target and timeframe. i.e. Buy xxx @ 50 exit @75/85.

Or else what is happened I bought xxx@50 and didn't book profit as there is no target, and after a week/months it hit SL.

What do you suggest this scenario.

Sahu

May 23, 2014

Logic of a 10% stoploss

Every now and then I write buy so-and-so with min 10% SL.

What is so great about this 10%? Why not 5% or 20%?

What is so great about this 10%? Why not 5% or 20%?

May 22, 2014

Intraday analysis

There was one buy signal which failed... now while I have plotted the signal, this is only for academic purposes.

May 21, 2014

Market outlook

Broader trend up.... but markets form a lower high lower low candlestick. This is the first one and 2-3 are allowable in a rally. Now the trading ranges are getting smaller and it may not make sense to micro analyse these small moves.

AFL for ATR based SL

Some time ago, I posted an AFL for a simple trailing stoploss.

Today I will write about ATR based stoplosses and how it differs from other stoplosses.

Today I will write about ATR based stoplosses and how it differs from other stoplosses.

May 20, 2014

Market outlook

Consider trend as up with immediate support at 7000. Most recent significant swing low still remains at 6640.

Pivot point trading

Trading pivot points along with support and resistance levels is a common strategy employed by day traders and sometimes, positional traders.

Question: options vs futures in a bullish market

Question posted by site visitor:

I too share your bullish stance on nifty & bank nifty. With both these indices making higher tops & bottoms as they do in a bull case market, will the strategy of buying and holding out of the money call options till expiry of each month work? If this strategy does not work, could you please suggest how one could play these indices by buying call options as they have limited risks when compared to futures.

Your views on this.

Dinesh Babu

I too share your bullish stance on nifty & bank nifty. With both these indices making higher tops & bottoms as they do in a bull case market, will the strategy of buying and holding out of the money call options till expiry of each month work? If this strategy does not work, could you please suggest how one could play these indices by buying call options as they have limited risks when compared to futures.

Your views on this.

Dinesh Babu

May 19, 2014

Elliot wave analysis

According to VP, a well known EWT/ Neowave analyst, the current rally is a part of a bigger corrective structure. The current wave is the F wave and it is normal for this wave to make a new high or generate a breakout after which the G wave opens downwards.

Market outlook

Consider trend as up with SL at 7000. This level will become important to me in the days to come as chances of trend reversal will increase if this level is broken.

Fibonacci series and numbers

Perhaps one of the finest and most beautiful series ever discovered and why there is order in apparently chaotic events.

Fibonacci numbers are named after Leonardo Fibonacci, an Italian mathematician somewhere in the 10th century. These have originally discovered/ researched in ancient Indian mathematics.

NIFTY long term fibonacci projection

This is just a projection based on monthly charts and not an indication that the level will necessarily be achieved.

May 16, 2014

Weekend update

Trend is up though it appears that rally is likely to mature. Upside at this point looks limited given the rather strong selling at higher levels and as evidenced by candlestick with long upper tail.

NIFTY achieves first target 7200... 9000 next?

On 31-MAR when nifty was at 6700, I wrote "An excellent breakout on monthly charts. Trend is up and up.... 7200 next target?".

On 31-MAR when nifty was at 6700, I wrote "An excellent breakout on monthly charts. Trend is up and up.... 7200 next target?".

So did you make money? What did you buy? Calls? Puts? Or were long in stocks? Did you buy the breakouts I keep posting in this blog?

Now next target is 9000... but this will not come immediately. Suffice to say, that trade long... buy good stocks... buy all dips and do not short.

Deep support 6400.

Comments welcome...

May 15, 2014

Market outlook

Trend is up with support at 6850-6640 spot. Resistance is expected at 7200; above this rally possible to 7500.

Note possible formation of cluster island reversal. This is a bearish pattern and confirmation will be a gapdown opening below 7000.

Note possible formation of cluster island reversal. This is a bearish pattern and confirmation will be a gapdown opening below 7000.

Option writing clues are giving mixed signals.

Profit expectations from stock market

Several times, one experiences a situation where you buy a stock and another stock rallies. Or you wish you had stayed away from large caps and had invested in the smaller caps as they give better returns. One also learns through experience that half the trades fail or do not generate the expected returns.

In reality there is not much difference between different portfolios. After the initial 20-30 stocks, investing in different sets or larger sets is unlikely to improve overall performance.

In reality there is not much difference between different portfolios. After the initial 20-30 stocks, investing in different sets or larger sets is unlikely to improve overall performance.

May 14, 2014

Market outlook

Trend is still up with support at 6850-6640.

Note possible formation of cluster island reversal. This is a bearish pattern and confirmation will be a gapdown opening below 7000.

Note possible formation of cluster island reversal. This is a bearish pattern and confirmation will be a gapdown opening below 7000.

May 13, 2014

When opportunity comes, be prepared to move fast

When opportunity comes, be prepared to move fast... don't hesitate, relook, rethink etc.

You have waited for a very long time for this so when the opportunity comes, be prepared to strike fast.

You may not know when the next opportunity will come.

Watch this video...

Market outlook

Trend is up with support at 6850-6640 spot.

Note today's bar.... (a) gapup and (b) close near midway / towards low of the day.

The gapup was most likely caused by investors who missed this rally so far. The upper tail in the candlestick was caused by others/ smart money to book profits.

Note today's bar.... (a) gapup and (b) close near midway / towards low of the day.

The gapup was most likely caused by investors who missed this rally so far. The upper tail in the candlestick was caused by others/ smart money to book profits.

Using Quick Review mode in Amibroker

The Quick Review mode is an excellent feature in Amibroker which you can use to find top gainers and losers for a day, week, month, quarter or even a year.

To access it, just click the goggles like menu button and a small window will pop out. Select the options and click "Show". Incidentally you can even change the date so you do some study like "which were top gainers in a particular month etc".

To access it, just click the goggles like menu button and a small window will pop out. Select the options and click "Show". Incidentally you can even change the date so you do some study like "which were top gainers in a particular month etc".

May 12, 2014

NF 7000 call is priced at 295 levels

Options are extremely expensive and now the 7000 at-the-money call is priced at 295 with an implied volatility of 45.

Under normal steady state conditions assuming an IV of 15%, the fair value of a 7000 call is 110.

Once the elections results are out and the so called fear vanishes, chances are high that the IVs will drop and option prices will crash by min 50%.

Let's see... what happens.

Option calculator results:

Under normal steady state conditions assuming an IV of 15%, the fair value of a 7000 call is 110.

Once the elections results are out and the so called fear vanishes, chances are high that the IVs will drop and option prices will crash by min 50%.

Let's see... what happens.

Option calculator results:

Open interest hints at correction

Current open interest points to support at 6400 and resistance at 7000.

Note that resistance at 7000 has been defined from start of this series. Bias has been bullish.

However put writing levels have not shifted in direction of the rally which writers while bullish are expecting a correction. Logically I would expect option writing support at 6800 levels or so. This is not the case.

Now markets are already at this level so it will be interesting to see what happens.

Note that resistance at 7000 has been defined from start of this series. Bias has been bullish.

However put writing levels have not shifted in direction of the rally which writers while bullish are expecting a correction. Logically I would expect option writing support at 6800 levels or so. This is not the case.

Now markets are already at this level so it will be interesting to see what happens.

Intraday analysis

Breakout above initial trading range was bullish. First buy was above 6990F and second buy above 7005 / 7020 F.

Market outlook

NIFTY maintains uptrend and gains another 2%. Close was above 7000.

Advance decline was flat and not supporting the rally... this means people sold into the rally.

Advance decline was flat and not supporting the rally... this means people sold into the rally.

May 11, 2014

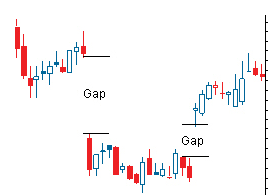

Question: What is definition of gap up & gap down?

Question posted by site visitor:

What is definition of gap up & gap down? How much the stock or index should open above the previous day's high or below the previous day's low to be called gap up/down opening ?

Next query is- Suppose I want to ride on the trend and I want to buy in uptrend ( or sell in downtrend). I want to put stop-loss buy order above the previous day's high ( or stop-loss sell order below the previous day's low). How much above that high ( or below low) I should put order?

Dr.Suhas Kothavale.

Dr.Suhas Kothavale.

May 10, 2014

How to identify overbought / oversold stocks using Amibroker

Many people get fascinated by overbought/ oversold stocks. This AFL will help you identify stocks which are oversold / overbought.

The basic indicator used here is RSI. Readings above 80 are considered overbought and readings below 20 as oversold.

For convenience, I have posted the code for both 5 days and 14 days.

The basic indicator used here is RSI. Readings above 80 are considered overbought and readings below 20 as oversold.

For convenience, I have posted the code for both 5 days and 14 days.

May 9, 2014

How to identify stocks making 52 weeks highs without charts

Here is a simple way to easily identify stocks making 52 week highs without charts.

Weekend update

Nice to see a strongly positive close after a long time. The icing was this happened on a Friday so expect more gains from here on.

This is how the EOD charts look...

This is how the EOD charts look...

Intraday analysis

Today was a simple one way up market... breakout levels are drawn in horizontal green line.

The first bar is not so obvious but when compared to previous days chart, it becomes a compelling buy.

Note that no amount of analysis can predict a rally like todays. But a trailing SL helps you lock in a trade.

The first bar is not so obvious but when compared to previous days chart, it becomes a compelling buy.

Note that no amount of analysis can predict a rally like todays. But a trailing SL helps you lock in a trade.

May 8, 2014

Scanner mode in Amibroker

Amibroker has a scanner utility where you can define buy, sell, short, cover strategies.

This is a simple test strategy to demonstrate how simple it is easy to code. Note that I just made up this example so do not jump in and trade blindly.

Buy - when stock closes above 20 dma

Sell - when stock closes below 5 dma but is already bullish

Short - when stock closes below 20 dma

Cover - when stock closes above 5 dma but is already bearish

This is a simple test strategy to demonstrate how simple it is easy to code. Note that I just made up this example so do not jump in and trade blindly.

Buy - when stock closes above 20 dma

Sell - when stock closes below 5 dma but is already bullish

Short - when stock closes below 20 dma

Cover - when stock closes above 5 dma but is already bearish

Market outlook

Trend is up with support at 6640.

There is possible formation of H&S pattern on EOD charts... neckline is at 6640. If this breaks decisively, one can expect a correction to 6400 levels.

Sustaining above 6750 spot will be bullish. Close above this will also mean bullishness on weekly charts.

Option writing points to support at 6400 and resistance at 7000.

There is possible formation of H&S pattern on EOD charts... neckline is at 6640. If this breaks decisively, one can expect a correction to 6400 levels.

Sustaining above 6750 spot will be bullish. Close above this will also mean bullishness on weekly charts.

Option writing points to support at 6400 and resistance at 7000.

May 7, 2014

Amibroker AFLs

Starting a series of posts on writing Amibroker AFLs.

For newbies, Amibroker is one of the finest trading/ charting softwares. You can download a trial version from amibroker.com.

May 6, 2014

May 5, 2014

May 4, 2014

May 2, 2014

Subscribe to:

Posts (Atom)