April 30, 2014

April 29, 2014

April 28, 2014

Market outlook

We had a poor follow through post Friday's sell off. This means the correction is likely to get over sooner than later most probably around 6700 levels. If at all this level breaks, the market will offer a good buy-on-dips opportunity between 6600 and 6700.

Trade accordingly.

Option writing points to support at 6500 and resistance at 7000.

Trade accordingly.

Option writing points to support at 6500 and resistance at 7000.

April 25, 2014

RSI divergence in NIFTY

I rarely see RSI but today I saw out of curiosity and voila... we have negative divergence on daily charts.

The reason I don't see this is when you are in markets long enough the price behaviour will start hinting at some reversal. You can actually sense some distribution happening.

The reason I don't see this is when you are in markets long enough the price behaviour will start hinting at some reversal. You can actually sense some distribution happening.

Weekend update

Possible trend reversal on EOD charts as markets close below 3 days' low. Next week, a fast close below 6640 will mean confirmation of trend reversal.

Note that there were warnings of this for past week days... smaller bars, no blast off rally at new highs, option writing pointing to strong resistance at 7000 and possibility of a deep correction (without breaking 6000).

Current OI points to resistance at 7000 and support at 6500-6000.

Note that there were warnings of this for past week days... smaller bars, no blast off rally at new highs, option writing pointing to strong resistance at 7000 and possibility of a deep correction (without breaking 6000).

Current OI points to resistance at 7000 and support at 6500-6000.

April 24, 2014

NIFTY megacycles by Kamlesh Uttam

One blog I read quite regularly because of the methods is uttamsmethodofselling.blogspot.in/.

This is an excellent blog and a must read for those who like to improve on their trading skills.

This is an excellent blog and a must read for those who like to improve on their trading skills.

Open interest show large range in MAY

Option writers are preparing for a big range and volatility in MAY.

They are not expecting markets to cross 7000 in MAY and not break 6000 on the downside.

Since markets are close to the upper range than the lower range, chances of a correction cannot be ruled out.

To negate this scenario, open interest at 6000 and lower puts should be highest.

They are not expecting markets to cross 7000 in MAY and not break 6000 on the downside.

Since markets are close to the upper range than the lower range, chances of a correction cannot be ruled out.

To negate this scenario, open interest at 6000 and lower puts should be highest.

April 23, 2014

Market outlook

Trend is up with support at 6640... note that trend appears as if it is weakening. The reason is we are at new highs and while markets should have blasted this is not happening and we are seeing smaller bars.

So markets are making new highs but there is no follow through buying.

Option writing points to support at 6000 and resistance at 7000. The deep support may mean that writers are expecting limited upsides but a big correction from current levels.

So markets are making new highs but there is no follow through buying.

Option writing points to support at 6000 and resistance at 7000. The deep support may mean that writers are expecting limited upsides but a big correction from current levels.

Trading range 1000 points in MAY?

Option writers are preparing for a big range and volatility in MAY.

They are not expecting markets to cross 7000 in MAY and not break 6000 on the downside. Now 1000 points is a big big range.

This automatically means limited upsides from here while indicating that markets may correct substantially.

Let's see...

NOTE:

1.We will get a better picture on FRIDAY after expiry of current series.

2.Options are very expensive so it may not be easy to earn money.

They are not expecting markets to cross 7000 in MAY and not break 6000 on the downside. Now 1000 points is a big big range.

This automatically means limited upsides from here while indicating that markets may correct substantially.

Let's see...

NOTE:

1.We will get a better picture on FRIDAY after expiry of current series.

2.Options are very expensive so it may not be easy to earn money.

April 22, 2014

April 21, 2014

April 17, 2014

Intraday analysis

There were 2 buy signals today... one on crossover of 6720F and second on crossover of 6760F.

A question may arise that when the last 2 days trend was down, how could one initiate a long call? The justification for this is that markets (on EOD charts) were very close to support and a bounce was due.

The big bar on 5 min charts (6720F crossover) was a confirmation of intraday bullishness.

A question may arise that when the last 2 days trend was down, how could one initiate a long call? The justification for this is that markets (on EOD charts) were very close to support and a bounce was due.

The big bar on 5 min charts (6720F crossover) was a confirmation of intraday bullishness.

Sensex @ 40000

CLSA says that as per technicals the BSE benchmark Sensex is all set for 39,707 level, an upside of over 75 per cent from its present level of 22,330.80 over 12-24 months.

My view: I am expecting a breakout in 2014/ 2015 and we will have a rally similar to the one in 2003-2008 when the nifty shot from 1000 to 6000.

Also, swing traders and investors will make far more money than day traders. This is true of all markets.

Also, swing traders and investors will make far more money than day traders. This is true of all markets.

April 16, 2014

Market outlook

Trend is up above 6640 spot.

Real support will come in around 6600 spot... this is the level where there is substantial put writing.

Note that there is a change in sentiment (first time) and 6800 now has the highest open interest. This may mean that markets will not cross 6800 this month.

Interestingly, last few days markets was going up and so was VIX. Now markets dropped today and VIX dropped by 2%.

Real support will come in around 6600 spot... this is the level where there is substantial put writing.

Note that there is a change in sentiment (first time) and 6800 now has the highest open interest. This may mean that markets will not cross 6800 this month.

Interestingly, last few days markets was going up and so was VIX. Now markets dropped today and VIX dropped by 2%.

April 15, 2014

April 12, 2014

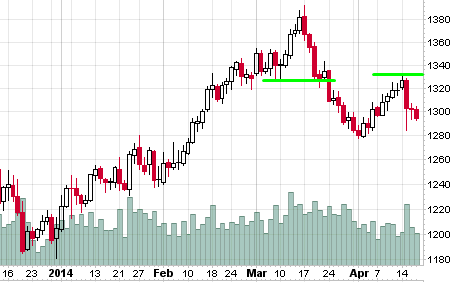

US markets

The Dow Jones has been trading in a range between 15300 and 16600 for quite some. It has now lost 600 points off the highs and has also broken and closed below the recent swing low.

April 11, 2014

April 10, 2014

Market outlook

Trend is up with support at 6640. Considering yesterday's rally, a sideways movement of 1-2 days is perfectly in order.

So unless markets break this level in 2 days, I will not consider any sort of trend reversal.

This is not a market for shorting so keep buying the dips. I am saying this because I am getting desperate calls from people who are shorting from 6200 levels and do not believe in stoploss. Now they are paying (very rightly) for their follies.

I have no target for this rally... 7200 is the nearest Fibonacci resistance level... after that who knows and who cares. Just follow the trend which is up right now and hold all positions with a trailing stoploss.

So unless markets break this level in 2 days, I will not consider any sort of trend reversal.

This is not a market for shorting so keep buying the dips. I am saying this because I am getting desperate calls from people who are shorting from 6200 levels and do not believe in stoploss. Now they are paying (very rightly) for their follies.

I have no target for this rally... 7200 is the nearest Fibonacci resistance level... after that who knows and who cares. Just follow the trend which is up right now and hold all positions with a trailing stoploss.

April 9, 2014

Market outlook (NIFTY and B.NIFTY)

In a previous post, I mentioned that the "... expected correction has started or may even be ending!".

Two days of lower highs and lower lows is all we got and this is enough in a bull market.

Right enough, the correction ended faster than it ever started and trapped everyone who are desperately looking for an opportunity to short a rising market.

Advance decline was excellent.

Two days of lower highs and lower lows is all we got and this is enough in a bull market.

Right enough, the correction ended faster than it ever started and trapped everyone who are desperately looking for an opportunity to short a rising market.

Advance decline was excellent.

April 7, 2014

April 6, 2014

Example of risk management

RANBAXY... an interesting trade. This stock was not on my watchlist but someone at my brokerage shorted when it was up 10%. According to him, the 10% move was not warranted and so he shorted.

April 4, 2014

Weekly update

On daily charts, nifty formed lower high lower low... this is the first sign of the correction (yesterday's outside bar was a rough warning). The intraday charts however show a great deal of struggle to come down.

Intraday analysis

Weak and rangebound day. There was only one possible short trade when nifty crossed the day's high but failed to sustain above it. Expectedly, the rangebound nature of the market limited the gains.

Incidentally break of day's low (9.45 bar) is NOT a short trade (shown with arrow) as the bar closing was midway.

Incidentally break of day's low (9.45 bar) is NOT a short trade (shown with arrow) as the bar closing was midway.

RKSV offers 5 free trades every month

RKSV Dream plan offers:

- Free Trading: 5 free trades each month, for life.

- Rs. 20 per order traded afterwards, regardless of the size of the trade.

- Applies to all segments: Cash (Equities), Futures, Options, Currency Futures and Options, and MCX Futures.

- No monthly commitments.

- Enjoy intraday leverage of 20x on equities, 2.5x on NSE F&O, 2x on NSE Currency F&O and 2x on MCX Futures.

Read more about the planApril 3, 2014

April 2, 2014

April 1, 2014

Buying a stock after a big move

Can you buy a stock AFTER it has already moved 10% in a day? Or say it is at lifetime high? Or at 52 week high? If yes, you are on your way to be a good trader.

Market outlook

No signs of any correction while nifty is still maintaining formation of higher highs and higher lows intact.

While a correction is overdue, it may be a short affair with the broader sense veering towards buy on dips.

While a correction is overdue, it may be a short affair with the broader sense veering towards buy on dips.

Intraday analysis

Past 2-3 days, markets are seeing selling followed by immediate buying. Today was no different.

Subscribe to:

Posts (Atom)