Question posted by site visitor:

What is definition of gap up & gap down? How much the stock or index should open above the previous day's high or below the previous day's low to be called gap up/down opening ?

Next query is- Suppose I want to ride on the trend and I want to buy in uptrend ( or sell in downtrend). I want to put stop-loss buy order above the previous day's high ( or stop-loss sell order below the previous day's low). How much above that high ( or below low) I should put order?

Dr.Suhas Kothavale.

Dr.Suhas Kothavale.

My answer:

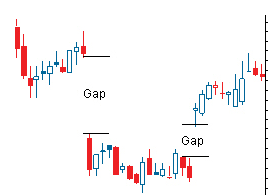

A gap occurs when the price of a security opens above or below the previous day's (or bar's) close.

A gap should be visually obvious as one. You cannot define or put a limit like 1% or .5% etc. It does not make sense. If you can see the gap immediately on the chart, then it is a gap. If you are struggling to see a gap, then ignore it.

Reg your second question, I am assuming this is for a positional trade. In this case, consider a trade only after completion of current bar (end of day). No point in putting a stoploss buy because it is normal for stocks to cross the previous days high and then close near the day's low... in this case, the buy has a good chance of failing.

Whatever timeframe you are using, always wait for the candle to get completed and then decide on the trade. So if your rule says buy on close above previous bar's high and this actually happens but close is near the low, then you should ignore the trade.

The position of the gap is also important. In most cases, the first gap is reliable... the 3rd/ 4th gap is the one one should sell into... this is caused by people who missed all the rallies and then are convinced the rally is real. This last gap is often called the exhaustion gap and is actually a bearish sign when it happens in a uptrend.

Hope this helps.

No comments:

Post a Comment